The

The

The

only

only

only

REIT

REIT

REIT

where

where

where

the

the

renters

renters

are

are

are

your

your

your

partners,

partners,

not

not

tenants.

tenants.

renters

the

not

tenants.

partners,

Roots is a Reg A+ REIT. With a REIT, you can see returns both through the income generated by the properties purchased by the fund and through the property’s value growing over time.

Roots is a Reg A+ REIT. With a REIT, you can see returns both through the income generated by the properties purchased by the fund and through the property’s value growing over time.

Roots is a Reg A+ REIT. With a REIT, you can see returns both through the income generated by the properties purchased by the fund and through the property’s value growing over time.

Fund Overview

Roots REIT

Roots is a private Real Estate Investment Trust (REIT) that allows anyone to build wealth through a portfolio of income-generating residential properties. With over 20,500+ investors and national recognition on CNN, FOX, CNBC, Morning Brew, 1440, and The Pour Over, Roots is reshaping how people invest in real estate. What sets it apart is the “Live In It Like You Own It®” program, where renters can earn rewards to invest for paying rent on time, caring for their home, and being a good neighbor. This alignment creates stronger communities and better outcomes for renters, investors, and the community.

Roots is a private Real Estate Investment Trust (REIT) that allows anyone to build wealth through a portfolio of income-generating residential properties. With over 20,500+ investors and national recognition on CNN, FOX, CNBC, Morning Brew, 1440, and The Pour Over, Roots is reshaping how people invest in real estate. What sets it apart is the “Live In It Like You Own It®” program, where renters can earn rewards to invest for paying rent on time, caring for their home, and being a good neighbor. This alignment creates stronger communities and better outcomes for renters, investors, and the community.

By investing in Roots, you’re buying into a professionally managed fund of residential properties. Your returns come from rental income and property appreciation. Anyone can invest with as little as $100. Investors receive quarterly cash distributions with the option to reinvest or withdraw. Liquidity is available every quarter, with no withdrawal penalty after your investment's first year, subject to the terms outlined in the Offering Circular. If you invest by February 28th, you’ll be eligible to qualify for the Q1 2026 distribution. Join us in our mission to help one million people build wealth through socially conscious real estate investing!

By investing in Roots, you’re buying into a professionally managed fund of residential properties. Your returns come from rental income and property appreciation. Anyone can invest with as little as $100. Investors receive quarterly cash distributions with the option to reinvest or withdraw. Liquidity is available every quarter, with no withdrawal penalty after your investment's first year, subject to the terms outlined in the Offering Circular. If you invest by February 28th, you’ll be eligible to qualify for the Q1 2026 distribution. Join us in our mission to help one million people build wealth through socially conscious real estate investing!

Portfolio Map

Atlanta

Atlanta

283 Properties

283 Properties

Augusta

Augusta

87 Properties

87 Properties

Oklahoma City

Oklahoma City

44 Properties

44 Properties

Nashville

Nashville

62 Properties

62 Properties

Featured Properties

Single Family

Ashland City

,

TN

Laurel Way

3 Bed

2 Bath

1 Unit

Single Family

OKC

,

OK

NW 132nd Place

3 Bed

3 Bath

1 Unit

Single Family

Yukon

,

OK

Carlow Way

4 Bed

3 Bath

1 Unit

Single Family

Augustaa

,

GA

Hearthstone Townhomes

3 Bed

2.5 Bath

14 Units

Q4 Important Dates

February 28th, 2026

February 28th, 2026

February 28th, 2026

Q1 Distribution Cutoff

29 : 09 : 48 : 56

Fund Deadlines

Jan 1st

Jan 1st

Jan 1st

Start of Quarter

Start of Quarter

Mar 31st

Mar 31st

Mar 31st

End of Quarter

End of Quarter

Apr 10th

Apr 10th

Apr 10th

Est. Quarterly Payout

Est. Quarterly Payout

Apr 1st

Apr 1st

Apr 1st

Unit Price Update

Unit Price Update

Distributions Last Quarter

$998,328

Total Doors

Total Properties

Total Properties

476

476

476

611

611

611

Doors

Net Asset Value

$102,758,398

Target Annual Returns

12-15%

Resident Impact

$1.6M+

$1.6M+

$1.6M+

As of Oct 10th, 2025

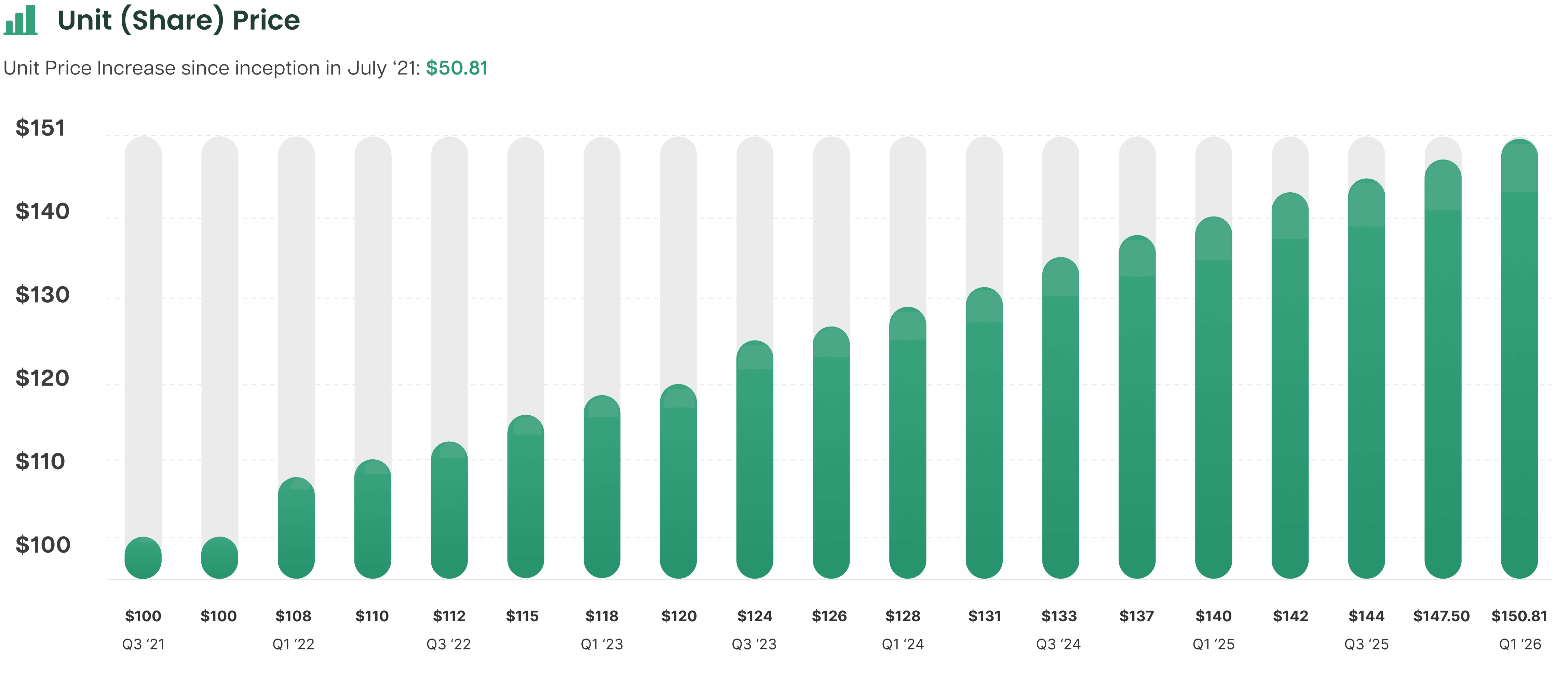

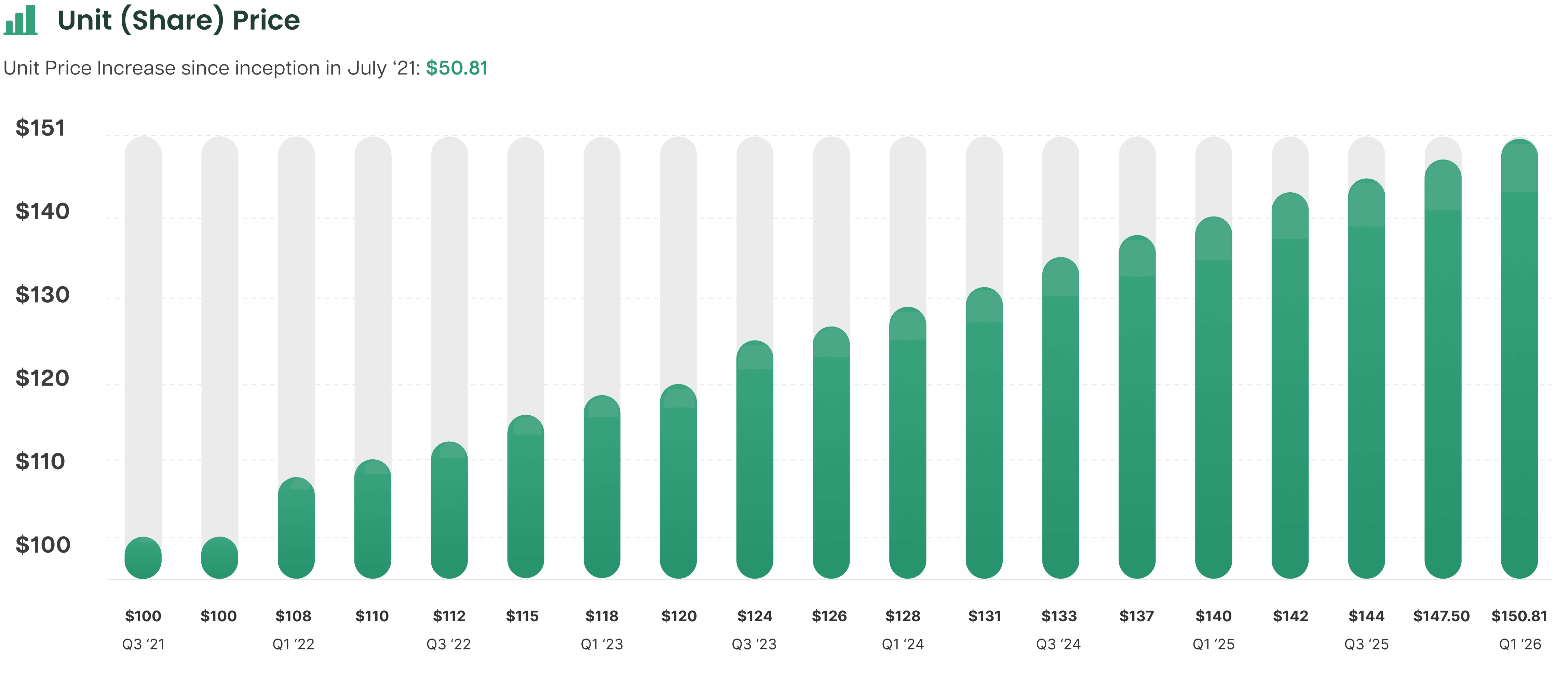

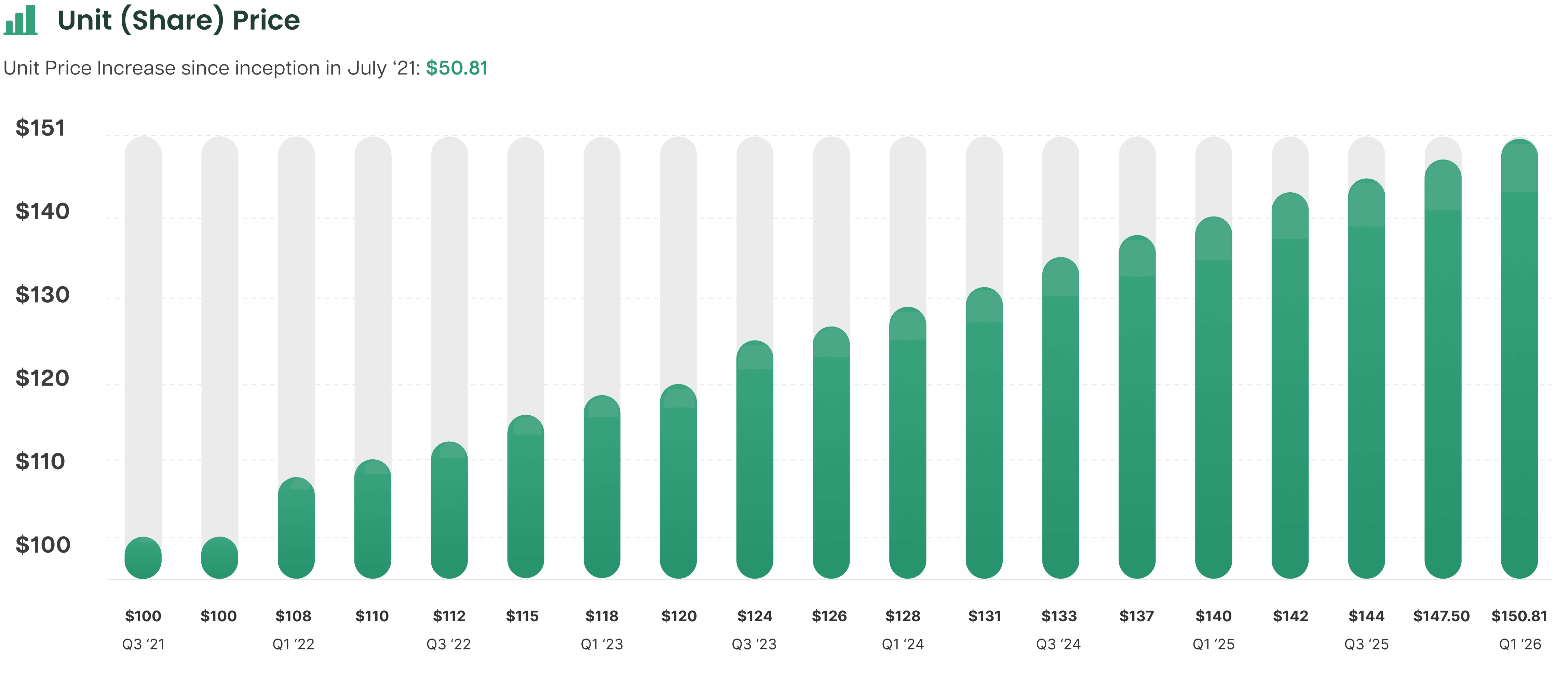

Price Per Unit

$150.81

$150.81

$150.81

Trailing 12 Months Return

Trailing 12 Months

12.01%

12.01%

12.01%

01/10/25 - 01/10/26

Avg Annual Return

Average Annual Return

17.29%

01/10/25 - 01/10/26

7/1/21 - 01/10/26

7/1/21 - 01/10/26

Historical Returns

What is a Unit?

Unit Price

Distributions

Quarter over Quarter

Historical Returns

What is a Unit?

Unit Price

Distributions

Quarter over Quarter

Fund Metrics

As of Jan 10th, 2026

Price Per Unit

$150.81

Distributions Last Quarter

$998,328

Target Annual Returns

12-15%

Average Annual Return

17.29%

7/1/21 - 01/10/26

Trailing 12 Months Return

12.01%

01/10/25 - 01/10/26

Total Properties

476

611

Doors

Net Asset Value

$102,758,398

Resident Impact

$1.6M+

Historical Returns

What is a Unit?

Unit Price

Distributions

Quarter over Quarter

"Roots is leveling the playing field."

“As long as the wealth gap keeps widening, generations of people are getting left behind. We can change that at Roots, and I feel like this might be the best team I've ever played on.”

Dominique Wilkins

NBA Hall of Famer

"The best real estate investing concept I've ever seen."

“Roots is the single best real estate investment concept I’ve ever seen. Investors, renters, and the city of Atlanta all win big”

Ted Jenkin

National TV Money Expert

"My highest performing investment"

"I thought it was really awesome how my investments could both help me grow my money and give back to other people. I'd never really seen something like that before."

Deana

Investor

Watch Testimonial

"Wish I Had Roots 42 years ago!"

"I've been investing 10% of my paycheck for 42 years but I've never been able to invest in real estate confidently until Roots. It's low entry, has great dividend returns and appreciation, but it also helps the community."

Norm

Investor

"My investment grew from $1,750 to $5,353"

"I decided to reinvest $500 and I still get take home over $3,000. It feels amazing to see my money working for me!"

Latrena R.

Renter & Investor

"We Love the social Impact!"

"When looking to invest in real estate we found Roots. We love that Roots residents build wealth with us."

Cameron Hamilton

Investor

"I'm so thankful for this opportunity"

"During these two years, Roots has become my highest performing investment. This has given me the opportunity to make an impact and make money."

Jillian

Investor

Watch Testimonial

"An Easy Decision"

"Not only is Roots a strong model for generating returns, it creates opportunities for others to build wealth in real estate when they wouldn’t otherwise have the opportunity."

Raj

Investor

"My credit score is up by 191pts..."

"Because of Roots, my credit score went from 520 to 711 in less than two years!"

Antonio D.

Renter & Investor

"Investing in Roots was an easy decision"

"Roots is a great opportunity to earn excellent returns while having a definitive, positive impact on people."

Ashton and Colin

Investors

"I can call them and a real person answers the phone!"

"If you're considering investing and you also want to feel good about where you're investing, I'd recommend checking out Roots."

Lauren

Investor

Watch Testimonial

"Investing with a 💚"

"Real estate investing that's easy, only $100 to get started and you get amazing returns that help you and the residents who live in the properties."

Kristen & Jake

Investors

"Why choose between your beliefs and bank account?"

"In a world where it's nearly impossible to align my Christian values with my financial goals I felt so relieved to find Roots."

Dana

Investor

Watch Testimonial

"Roots is leveling the playing field."

“As long as the wealth gap keeps widening, generations of people are getting left behind. We can change that at Roots, and I feel like this might be the best team I've ever played on.”

Dominique Wilkins

NBA Hall of Famer

"The best real estate investing concept I've ever seen."

“Roots is the single best real estate investment concept I’ve ever seen. Investors, renters, and the city of Atlanta all win big”

Ted Jenkin

National TV Money Expert

"My highest performing investment"

"I thought it was really awesome how my investments could both help me grow my money and give back to other people. I'd never really seen something like that before."

Deana

Investor

Watch Testimonial

"Wish I Had Roots 42 years ago!"

"I've been investing 10% of my paycheck for 42 years but I've never been able to invest in real estate confidently until Roots. It's low entry, has great dividend returns and appreciation, but it also helps the community."

Norm

Investor

"My investment grew from $1,750 to $5,353"

"I decided to reinvest $500 and I still get take home over $3,000. It feels amazing to see my money working for me!"

Latrena R.

Renter & Investor

"We Love the social Impact!"

"When looking to invest in real estate we found Roots. We love that Roots residents build wealth with us."

Cameron Hamilton

Investor

"I'm so thankful for this opportunity"

"During these two years, Roots has become my highest performing investment. This has given me the opportunity to make an impact and make money."

Jillian

Investor

Watch Testimonial

"An Easy Decision"

"Not only is Roots a strong model for generating returns, it creates opportunities for others to build wealth in real estate when they wouldn’t otherwise have the opportunity."

Raj

Investor

"My credit score is up by 191pts..."

"Because of Roots, my credit score went from 520 to 711 in less than two years!"

Antonio D.

Renter & Investor

"Investing in Roots was an easy decision"

"Roots is a great opportunity to earn excellent returns while having a definitive, positive impact on people."

Ashton and Colin

Investors

"I can call them and a real person answers the phone!"

"If you're considering investing and you also want to feel good about where you're investing, I'd recommend checking out Roots."

Lauren

Investor

Watch Testimonial

"Investing with a 💚"

"Real estate investing that's easy, only $100 to get started and you get amazing returns that help you and the residents who live in the properties."

Kristen & Jake

Investors

"Why choose between your beliefs and bank account?"

"In a world where it's nearly impossible to align my Christian values with my financial goals I felt so relieved to find Roots."

Dana

Investor

Watch Testimonial

"Roots is leveling the playing field."

“As long as the wealth gap keeps widening, generations of people are getting left behind. We can change that at Roots, and I feel like this might be the best team I've ever played on.”

Dominique Wilkins

NBA Hall of Famer

"The best real estate investing concept I've ever seen."

“Roots is the single best real estate investment concept I’ve ever seen. Investors, renters, and the city of Atlanta all win big”

Ted Jenkin

National TV Money Expert

"My highest performing investment"

"I thought it was really awesome how my investments could both help me grow my money and give back to other people. I'd never really seen something like that before."

Deana

Investor

Watch Testimonial

"Wish I Had Roots 42 years ago!"

"I've been investing 10% of my paycheck for 42 years but I've never been able to invest in real estate confidently until Roots. It's low entry, has great dividend returns and appreciation, but it also helps the community."

Norm

Investor

"My investment grew from $1,750 to $5,353"

"I decided to reinvest $500 and I still get take home over $3,000. It feels amazing to see my money working for me!"

Latrena R.

Renter & Investor

"We Love the social Impact!"

"When looking to invest in real estate we found Roots. We love that Roots residents build wealth with us."

Cameron Hamilton

Investor

"I'm so thankful for this opportunity"

"During these two years, Roots has become my highest performing investment. This has given me the opportunity to make an impact and make money."

Jillian

Investor

Watch Testimonial

"An Easy Decision"

"Not only is Roots a strong model for generating returns, it creates opportunities for others to build wealth in real estate when they wouldn’t otherwise have the opportunity."

Raj

Investor

"My credit score is up by 191pts..."

"Because of Roots, my credit score went from 520 to 711 in less than two years!"

Antonio D.

Renter & Investor

"Investing in Roots was an easy decision"

"Roots is a great opportunity to earn excellent returns while having a definitive, positive impact on people."

Ashton and Colin

Investors

"I can call them and a real person answers the phone!"

"If you're considering investing and you also want to feel good about where you're investing, I'd recommend checking out Roots."

Lauren

Investor

Watch Testimonial

"Investing with a 💚"

"Real estate investing that's easy, only $100 to get started and you get amazing returns that help you and the residents who live in the properties."

Kristen & Jake

Investors

"Why choose between your beliefs and bank account?"

"In a world where it's nearly impossible to align my Christian values with my financial goals I felt so relieved to find Roots."

Dana

Investor

Watch Testimonial

"Roots is leveling the playing field."

“As long as the wealth gap keeps widening, generations of people are getting left behind. We can change that at Roots, and I feel like this might be the best team I've ever played on.”

Dominique Wilkins

NBA Hall of Famer

"The best real estate investing concept I've ever seen."

“Roots is the single best real estate investment concept I’ve ever seen. Investors, renters, and the city of Atlanta all win big”

Ted Jenkin

National TV Money Expert

"My highest performing investment"

"I thought it was really awesome how my investments could both help me grow my money and give back to other people. I'd never really seen something like that before."

Deana

Investor

Watch Testimonial

"Wish I Had Roots 42 years ago!"

"I've been investing 10% of my paycheck for 42 years but I've never been able to invest in real estate confidently until Roots. It's low entry, has great dividend returns and appreciation, but it also helps the community."

Norm

Investor

"My investment grew from $1,750 to $5,353"

"I decided to reinvest $500 and I still get take home over $3,000. It feels amazing to see my money working for me!"

Latrena R.

Renter & Investor

"We Love the social Impact!"

"When looking to invest in real estate we found Roots. We love that Roots residents build wealth with us."

Cameron Hamilton

Investor

"I'm so thankful for this opportunity"

"During these two years, Roots has become my highest performing investment. This has given me the opportunity to make an impact and make money."

Jillian

Investor

Watch Testimonial

"An Easy Decision"

"Not only is Roots a strong model for generating returns, it creates opportunities for others to build wealth in real estate when they wouldn’t otherwise have the opportunity."

Raj

Investor

"My credit score is up by 191pts..."

"Because of Roots, my credit score went from 520 to 711 in less than two years!"

Antonio D.

Renter & Investor

"Investing in Roots was an easy decision"

"Roots is a great opportunity to earn excellent returns while having a definitive, positive impact on people."

Ashton and Colin

Investors

"I can call them and a real person answers the phone!"

"If you're considering investing and you also want to feel good about where you're investing, I'd recommend checking out Roots."

Lauren

Investor

Watch Testimonial

"Investing with a 💚"

"Real estate investing that's easy, only $100 to get started and you get amazing returns that help you and the residents who live in the properties."

Kristen & Jake

Investors

"Why choose between your beliefs and bank account?"

"In a world where it's nearly impossible to align my Christian values with my financial goals I felt so relieved to find Roots."

Dana

Investor

Watch Testimonial

"Roots is leveling the playing field."

“As long as the wealth gap keeps widening, generations of people are getting left behind. We can change that at Roots, and I feel like this might be the best team I've ever played on.”

Dominique Wilkins

NBA Hall of Famer

"The best real estate investing concept I've ever seen."

“Roots is the single best real estate investment concept I’ve ever seen. Investors, renters, and the city of Atlanta all win big”

Ted Jenkin

National TV Money Expert

"My highest performing investment"

"I thought it was really awesome how my investments could both help me grow my money and give back to other people. I'd never really seen something like that before."

Deana

Investor

Watch Testimonial

"Wish I Had Roots 42 years ago!"

"I've been investing 10% of my paycheck for 42 years but I've never been able to invest in real estate confidently until Roots. It's low entry, has great dividend returns and appreciation, but it also helps the community."

Norm

Investor

"My investment grew from $1,750 to $5,353"

"I decided to reinvest $500 and I still get take home over $3,000. It feels amazing to see my money working for me!"

Latrena R.

Renter & Investor

"We Love the social Impact!"

"When looking to invest in real estate we found Roots. We love that Roots residents build wealth with us."

Cameron Hamilton

Investor

"I'm so thankful for this opportunity"

"During these two years, Roots has become my highest performing investment. This has given me the opportunity to make an impact and make money."

Jillian

Investor

Watch Testimonial

"An Easy Decision"

"Not only is Roots a strong model for generating returns, it creates opportunities for others to build wealth in real estate when they wouldn’t otherwise have the opportunity."

Raj

Investor

"My credit score is up by 191pts..."

"Because of Roots, my credit score went from 520 to 711 in less than two years!"

Antonio D.

Renter & Investor

"Investing in Roots was an easy decision"

"Roots is a great opportunity to earn excellent returns while having a definitive, positive impact on people."

Ashton and Colin

Investors

"I can call them and a real person answers the phone!"

"If you're considering investing and you also want to feel good about where you're investing, I'd recommend checking out Roots."

Lauren

Investor

Watch Testimonial

"Investing with a 💚"

"Real estate investing that's easy, only $100 to get started and you get amazing returns that help you and the residents who live in the properties."

Kristen & Jake

Investors

"Why choose between your beliefs and bank account?"

"In a world where it's nearly impossible to align my Christian values with my financial goals I felt so relieved to find Roots."

Dana

Investor

Watch Testimonial

"Roots is leveling the playing field."

“As long as the wealth gap keeps widening, generations of people are getting left behind. We can change that at Roots, and I feel like this might be the best team I've ever played on.”

Dominique Wilkins

NBA Hall of Famer

"The best real estate investing concept I've ever seen."

“Roots is the single best real estate investment concept I’ve ever seen. Investors, renters, and the city of Atlanta all win big”

Ted Jenkin

National TV Money Expert

"My highest performing investment"

"I thought it was really awesome how my investments could both help me grow my money and give back to other people. I'd never really seen something like that before."

Deana

Investor

Watch Testimonial

"Wish I Had Roots 42 years ago!"

"I've been investing 10% of my paycheck for 42 years but I've never been able to invest in real estate confidently until Roots. It's low entry, has great dividend returns and appreciation, but it also helps the community."

Norm

Investor

"My investment grew from $1,750 to $5,353"

"I decided to reinvest $500 and I still get take home over $3,000. It feels amazing to see my money working for me!"

Latrena R.

Renter & Investor

"We Love the social Impact!"

"When looking to invest in real estate we found Roots. We love that Roots residents build wealth with us."

Cameron Hamilton

Investor

"I'm so thankful for this opportunity"

"During these two years, Roots has become my highest performing investment. This has given me the opportunity to make an impact and make money."

Jillian

Investor

Watch Testimonial

"An Easy Decision"

"Not only is Roots a strong model for generating returns, it creates opportunities for others to build wealth in real estate when they wouldn’t otherwise have the opportunity."

Raj

Investor

"My credit score is up by 191pts..."

"Because of Roots, my credit score went from 520 to 711 in less than two years!"

Antonio D.

Renter & Investor

"Investing in Roots was an easy decision"

"Roots is a great opportunity to earn excellent returns while having a definitive, positive impact on people."

Ashton and Colin

Investors

"I can call them and a real person answers the phone!"

"If you're considering investing and you also want to feel good about where you're investing, I'd recommend checking out Roots."

Lauren

Investor

Watch Testimonial

"Investing with a 💚"

"Real estate investing that's easy, only $100 to get started and you get amazing returns that help you and the residents who live in the properties."

Kristen & Jake

Investors

"Why choose between your beliefs and bank account?"

"In a world where it's nearly impossible to align my Christian values with my financial goals I felt so relieved to find Roots."

Dana

Investor

Watch Testimonial

"Roots is leveling the playing field."

“As long as the wealth gap keeps widening, generations of people are getting left behind. We can change that at Roots, and I feel like this might be the best team I've ever played on.”

Dominique Wilkins

NBA Hall of Famer

"The best real estate investing concept I've ever seen."

“Roots is the single best real estate investment concept I’ve ever seen. Investors, renters, and the city of Atlanta all win big”

Ted Jenkin

National TV Money Expert

"My highest performing investment"

"I thought it was really awesome how my investments could both help me grow my money and give back to other people. I'd never really seen something like that before."

Deana

Investor

Watch Testimonial

"Wish I Had Roots 42 years ago!"

"I've been investing 10% of my paycheck for 42 years but I've never been able to invest in real estate confidently until Roots. It's low entry, has great dividend returns and appreciation, but it also helps the community."

Norm

Investor

"My investment grew from $1,750 to $5,353"

"I decided to reinvest $500 and I still get take home over $3,000. It feels amazing to see my money working for me!"

Latrena R.

Renter & Investor

"We Love the social Impact!"

"When looking to invest in real estate we found Roots. We love that Roots residents build wealth with us."

Cameron Hamilton

Investor

"I'm so thankful for this opportunity"

"During these two years, Roots has become my highest performing investment. This has given me the opportunity to make an impact and make money."

Jillian

Investor

Watch Testimonial

"An Easy Decision"

"Not only is Roots a strong model for generating returns, it creates opportunities for others to build wealth in real estate when they wouldn’t otherwise have the opportunity."

Raj

Investor

"My credit score is up by 191pts..."

"Because of Roots, my credit score went from 520 to 711 in less than two years!"

Antonio D.

Renter & Investor

"Investing in Roots was an easy decision"

"Roots is a great opportunity to earn excellent returns while having a definitive, positive impact on people."

Ashton and Colin

Investors

"I can call them and a real person answers the phone!"

"If you're considering investing and you also want to feel good about where you're investing, I'd recommend checking out Roots."

Lauren

Investor

Watch Testimonial

"Investing with a 💚"

"Real estate investing that's easy, only $100 to get started and you get amazing returns that help you and the residents who live in the properties."

Kristen & Jake

Investors

"Why choose between your beliefs and bank account?"

"In a world where it's nearly impossible to align my Christian values with my financial goals I felt so relieved to find Roots."

Dana

Investor

Watch Testimonial

"Roots is leveling the playing field."

“As long as the wealth gap keeps widening, generations of people are getting left behind. We can change that at Roots, and I feel like this might be the best team I've ever played on.”

Dominique Wilkins

NBA Hall of Famer

"The best real estate investing concept I've ever seen."

“Roots is the single best real estate investment concept I’ve ever seen. Investors, renters, and the city of Atlanta all win big”

Ted Jenkin

National TV Money Expert

"My highest performing investment"

"I thought it was really awesome how my investments could both help me grow my money and give back to other people. I'd never really seen something like that before."

Deana

Investor

Watch Testimonial

"Wish I Had Roots 42 years ago!"

"I've been investing 10% of my paycheck for 42 years but I've never been able to invest in real estate confidently until Roots. It's low entry, has great dividend returns and appreciation, but it also helps the community."

Norm

Investor

"My investment grew from $1,750 to $5,353"

"I decided to reinvest $500 and I still get take home over $3,000. It feels amazing to see my money working for me!"

Latrena R.

Renter & Investor

"We Love the social Impact!"

"When looking to invest in real estate we found Roots. We love that Roots residents build wealth with us."

Cameron Hamilton

Investor

"I'm so thankful for this opportunity"

"During these two years, Roots has become my highest performing investment. This has given me the opportunity to make an impact and make money."

Jillian

Investor

Watch Testimonial

"An Easy Decision"

"Not only is Roots a strong model for generating returns, it creates opportunities for others to build wealth in real estate when they wouldn’t otherwise have the opportunity."

Raj

Investor

"My credit score is up by 191pts..."

"Because of Roots, my credit score went from 520 to 711 in less than two years!"

Antonio D.

Renter & Investor

"Investing in Roots was an easy decision"

"Roots is a great opportunity to earn excellent returns while having a definitive, positive impact on people."

Ashton and Colin

Investors

"I can call them and a real person answers the phone!"

"If you're considering investing and you also want to feel good about where you're investing, I'd recommend checking out Roots."

Lauren

Investor

Watch Testimonial

"Investing with a 💚"

"Real estate investing that's easy, only $100 to get started and you get amazing returns that help you and the residents who live in the properties."

Kristen & Jake

Investors

"Why choose between your beliefs and bank account?"

"In a world where it's nearly impossible to align my Christian values with my financial goals I felt so relieved to find Roots."

Dana

Investor

Watch Testimonial

"Roots is leveling the playing field."

“As long as the wealth gap keeps widening, generations of people are getting left behind. We can change that at Roots, and I feel like this might be the best team I've ever played on.”

Dominique Wilkins

NBA Hall of Famer

"The best real estate investing concept I've ever seen."

“Roots is the single best real estate investment concept I’ve ever seen. Investors, renters, and the city of Atlanta all win big”

Ted Jenkin

National TV Money Expert

"My highest performing investment"

"I thought it was really awesome how my investments could both help me grow my money and give back to other people. I'd never really seen something like that before."

Deana

Investor

Watch Testimonial

"Wish I Had Roots 42 years ago!"

"I've been investing 10% of my paycheck for 42 years but I've never been able to invest in real estate confidently until Roots. It's low entry, has great dividend returns and appreciation, but it also helps the community."

Norm

Investor

"My investment grew from $1,750 to $5,353"

"I decided to reinvest $500 and I still get take home over $3,000. It feels amazing to see my money working for me!"

Latrena R.

Renter & Investor

"We Love the social Impact!"

"When looking to invest in real estate we found Roots. We love that Roots residents build wealth with us."

Cameron Hamilton

Investor

"I'm so thankful for this opportunity"

"During these two years, Roots has become my highest performing investment. This has given me the opportunity to make an impact and make money."

Jillian

Investor

Watch Testimonial

"An Easy Decision"

"Not only is Roots a strong model for generating returns, it creates opportunities for others to build wealth in real estate when they wouldn’t otherwise have the opportunity."

Raj

Investor

"My credit score is up by 191pts..."

"Because of Roots, my credit score went from 520 to 711 in less than two years!"

Antonio D.

Renter & Investor

"Investing in Roots was an easy decision"

"Roots is a great opportunity to earn excellent returns while having a definitive, positive impact on people."

Ashton and Colin

Investors

"I can call them and a real person answers the phone!"

"If you're considering investing and you also want to feel good about where you're investing, I'd recommend checking out Roots."

Lauren

Investor

Watch Testimonial

"Investing with a 💚"

"Real estate investing that's easy, only $100 to get started and you get amazing returns that help you and the residents who live in the properties."

Kristen & Jake

Investors

"Why choose between your beliefs and bank account?"

"In a world where it's nearly impossible to align my Christian values with my financial goals I felt so relieved to find Roots."

Dana

Investor

Watch Testimonial

"Roots is leveling the playing field."

“As long as the wealth gap keeps widening, generations of people are getting left behind. We can change that at Roots, and I feel like this might be the best team I've ever played on.”

Dominique Wilkins

NBA Hall of Famer

"The best real estate investing concept I've ever seen."

“Roots is the single best real estate investment concept I’ve ever seen. Investors, renters, and the city of Atlanta all win big”

Ted Jenkin

National TV Money Expert

"My highest performing investment"

"I thought it was really awesome how my investments could both help me grow my money and give back to other people. I'd never really seen something like that before."

Deana

Investor

Watch Testimonial

"Wish I Had Roots 42 years ago!"

"I've been investing 10% of my paycheck for 42 years but I've never been able to invest in real estate confidently until Roots. It's low entry, has great dividend returns and appreciation, but it also helps the community."

Norm

Investor

"My investment grew from $1,750 to $5,353"

"I decided to reinvest $500 and I still get take home over $3,000. It feels amazing to see my money working for me!"

Latrena R.

Renter & Investor

"We Love the social Impact!"

"When looking to invest in real estate we found Roots. We love that Roots residents build wealth with us."

Cameron Hamilton

Investor

"I'm so thankful for this opportunity"

"During these two years, Roots has become my highest performing investment. This has given me the opportunity to make an impact and make money."

Jillian

Investor

Watch Testimonial

"An Easy Decision"

"Not only is Roots a strong model for generating returns, it creates opportunities for others to build wealth in real estate when they wouldn’t otherwise have the opportunity."

Raj

Investor

"My credit score is up by 191pts..."

"Because of Roots, my credit score went from 520 to 711 in less than two years!"

Antonio D.

Renter & Investor

"Investing in Roots was an easy decision"

"Roots is a great opportunity to earn excellent returns while having a definitive, positive impact on people."

Ashton and Colin

Investors

"I can call them and a real person answers the phone!"

"If you're considering investing and you also want to feel good about where you're investing, I'd recommend checking out Roots."

Lauren

Investor

Watch Testimonial

"Investing with a 💚"

"Real estate investing that's easy, only $100 to get started and you get amazing returns that help you and the residents who live in the properties."

Kristen & Jake

Investors

"Why choose between your beliefs and bank account?"

"In a world where it's nearly impossible to align my Christian values with my financial goals I felt so relieved to find Roots."

Dana

Investor

Watch Testimonial

"Roots is leveling the playing field."

“As long as the wealth gap keeps widening, generations of people are getting left behind. We can change that at Roots, and I feel like this might be the best team I've ever played on.”

Dominique Wilkins

NBA Hall of Famer

"The best real estate investing concept I've ever seen."

“Roots is the single best real estate investment concept I’ve ever seen. Investors, renters, and the city of Atlanta all win big”

Ted Jenkin

National TV Money Expert

"My highest performing investment"

"I thought it was really awesome how my investments could both help me grow my money and give back to other people. I'd never really seen something like that before."

Deana

Investor

Watch Testimonial

"Wish I Had Roots 42 years ago!"

"I've been investing 10% of my paycheck for 42 years but I've never been able to invest in real estate confidently until Roots. It's low entry, has great dividend returns and appreciation, but it also helps the community."

Norm

Investor

"My investment grew from $1,750 to $5,353"

"I decided to reinvest $500 and I still get take home over $3,000. It feels amazing to see my money working for me!"

Latrena R.

Renter & Investor

"We Love the social Impact!"

"When looking to invest in real estate we found Roots. We love that Roots residents build wealth with us."

Cameron Hamilton

Investor

"I'm so thankful for this opportunity"

"During these two years, Roots has become my highest performing investment. This has given me the opportunity to make an impact and make money."

Jillian

Investor

Watch Testimonial

"An Easy Decision"

"Not only is Roots a strong model for generating returns, it creates opportunities for others to build wealth in real estate when they wouldn’t otherwise have the opportunity."

Raj

Investor

"My credit score is up by 191pts..."

"Because of Roots, my credit score went from 520 to 711 in less than two years!"

Antonio D.

Renter & Investor

"Investing in Roots was an easy decision"

"Roots is a great opportunity to earn excellent returns while having a definitive, positive impact on people."

Ashton and Colin

Investors

"I can call them and a real person answers the phone!"

"If you're considering investing and you also want to feel good about where you're investing, I'd recommend checking out Roots."

Lauren

Investor

Watch Testimonial

"Investing with a 💚"

"Real estate investing that's easy, only $100 to get started and you get amazing returns that help you and the residents who live in the properties."

Kristen & Jake

Investors

"Why choose between your beliefs and bank account?"

"In a world where it's nearly impossible to align my Christian values with my financial goals I felt so relieved to find Roots."

Dana

Investor

Watch Testimonial

"Roots is leveling the playing field."

“As long as the wealth gap keeps widening, generations of people are getting left behind. We can change that at Roots, and I feel like this might be the best team I've ever played on.”

Dominique Wilkins

NBA Hall of Famer

"The best real estate investing concept I've ever seen."

“Roots is the single best real estate investment concept I’ve ever seen. Investors, renters, and the city of Atlanta all win big”

Ted Jenkin

National TV Money Expert

"My highest performing investment"

"I thought it was really awesome how my investments could both help me grow my money and give back to other people. I'd never really seen something like that before."

Deana

Investor

Watch Testimonial

"Wish I Had Roots 42 years ago!"

"I've been investing 10% of my paycheck for 42 years but I've never been able to invest in real estate confidently until Roots. It's low entry, has great dividend returns and appreciation, but it also helps the community."

Norm

Investor

"My investment grew from $1,750 to $5,353"

"I decided to reinvest $500 and I still get take home over $3,000. It feels amazing to see my money working for me!"

Latrena R.

Renter & Investor

"We Love the social Impact!"

"When looking to invest in real estate we found Roots. We love that Roots residents build wealth with us."

Cameron Hamilton

Investor

"I'm so thankful for this opportunity"

"During these two years, Roots has become my highest performing investment. This has given me the opportunity to make an impact and make money."

Jillian

Investor

Watch Testimonial

"An Easy Decision"

"Not only is Roots a strong model for generating returns, it creates opportunities for others to build wealth in real estate when they wouldn’t otherwise have the opportunity."

Raj

Investor

"My credit score is up by 191pts..."

"Because of Roots, my credit score went from 520 to 711 in less than two years!"

Antonio D.

Renter & Investor

"Investing in Roots was an easy decision"

"Roots is a great opportunity to earn excellent returns while having a definitive, positive impact on people."

Ashton and Colin

Investors

"I can call them and a real person answers the phone!"

"If you're considering investing and you also want to feel good about where you're investing, I'd recommend checking out Roots."

Lauren

Investor

Watch Testimonial

"Investing with a 💚"

"Real estate investing that's easy, only $100 to get started and you get amazing returns that help you and the residents who live in the properties."

Kristen & Jake

Investors

"Why choose between your beliefs and bank account?"

"In a world where it's nearly impossible to align my Christian values with my financial goals I felt so relieved to find Roots."

Dana

Investor

Watch Testimonial

FAQs

Frequently Asked Questions

How long am I committed to the investment?

How is the cost of each unit determined?

How does the unit price affect my returns?

How do the quarterly distributions work?

Do I have the option to make a recurring investment each month?

Is Roots a REIT?

What markets are Roots properties in?

Liquidity and Fees

FAQs

Frequently Asked Questions

How long am I committed to the investment?

How is the cost of each unit determined?

How does the unit price affect my returns?

How do the quarterly distributions work?

Do I have the option to make a recurring investment each month?

Is Roots a REIT?

What markets are Roots properties in?

Liquidity and Fees

FAQs

Frequently Asked Questions

How long am I committed to the investment?

How is the cost of each unit determined?

How does the unit price affect my returns?

How do the quarterly distributions work?

Do I have the option to make a recurring investment each month?

Is Roots a REIT?

What markets are Roots properties in?

Liquidity and Fees

Still have questions? Meet with a Roots partner on a live webinar!

Still have questions? Meet with a Roots partner on a live webinar!