Roots Reviews

Roots Reviews

CEO, Daniel Dorfman joins Jason Calacanis on TWiST

What is Roots and what makes it different from the other real estate investing platforms?

CEO, Daniel Dorfman joins Jason Calacanis on TWiST

FAQ

Here is a list of common questions and answers related to Roots

How long am I committed to the investment?

Although we recommend holding your investment for at least a year, we understand that things happen and offer liquidity each quarter. Please refer to our offering circular for full details.

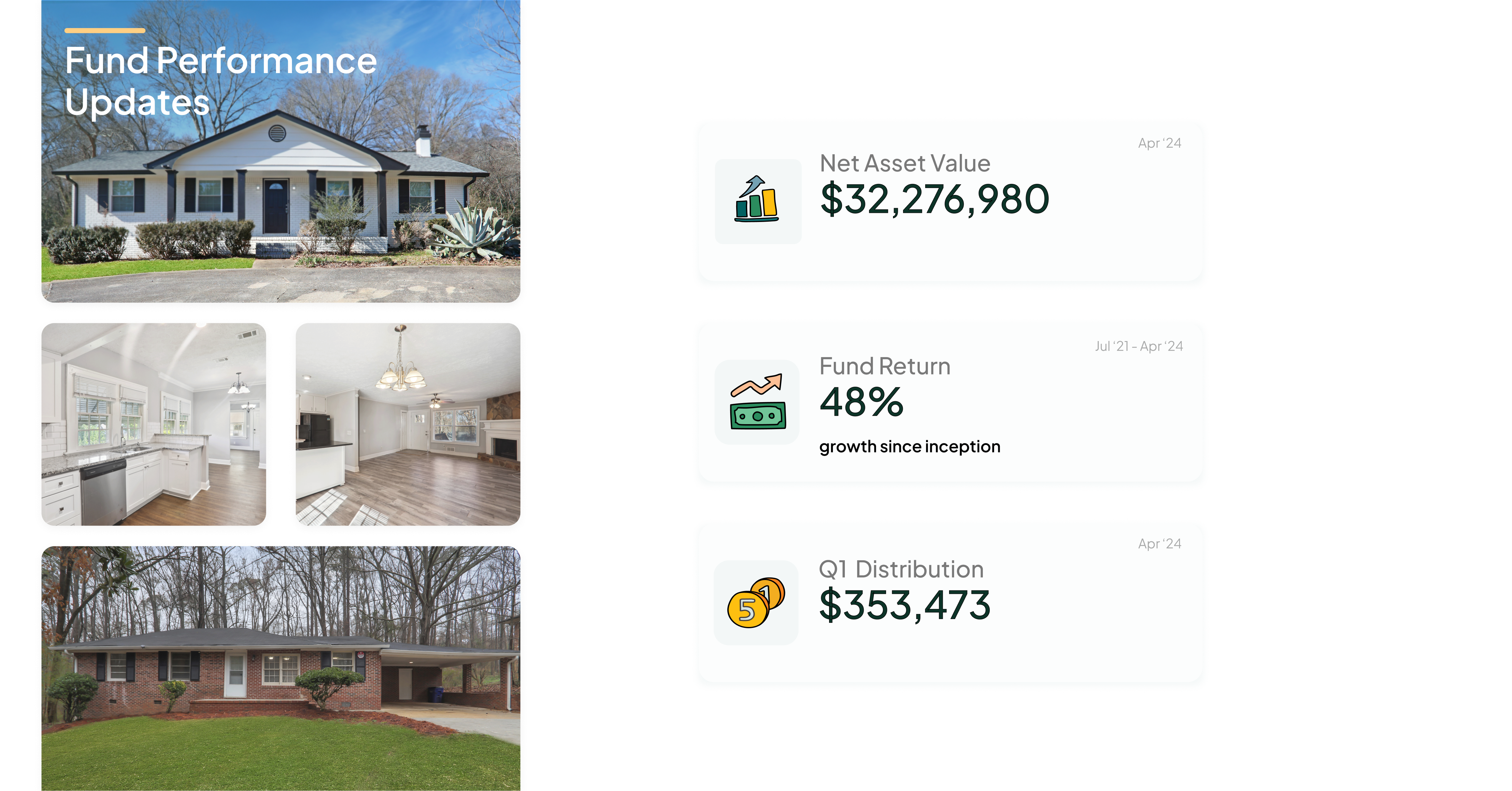

How is the cost of each unit determined?

At the end of each quarter the fund evaluates its current Net Asset Value (NAV). This calculation is simple. We take the market value of all of the properties plus all accounts receivable and all cash on hand. We then subtract any debts and liabilities. After this calculation is made, we take the total NAV and divide it by the amount of outstanding units to get the unit price for the next quarter.

How do the quarterly distributions work?

Investors have the option to reinvest or cash out their distributions at the end of each quarter.

Do I have the option to make a recurring investment each month?

Yes, with the Roots investment platform you will have the option to set investments to recur either monthly or quarterly.

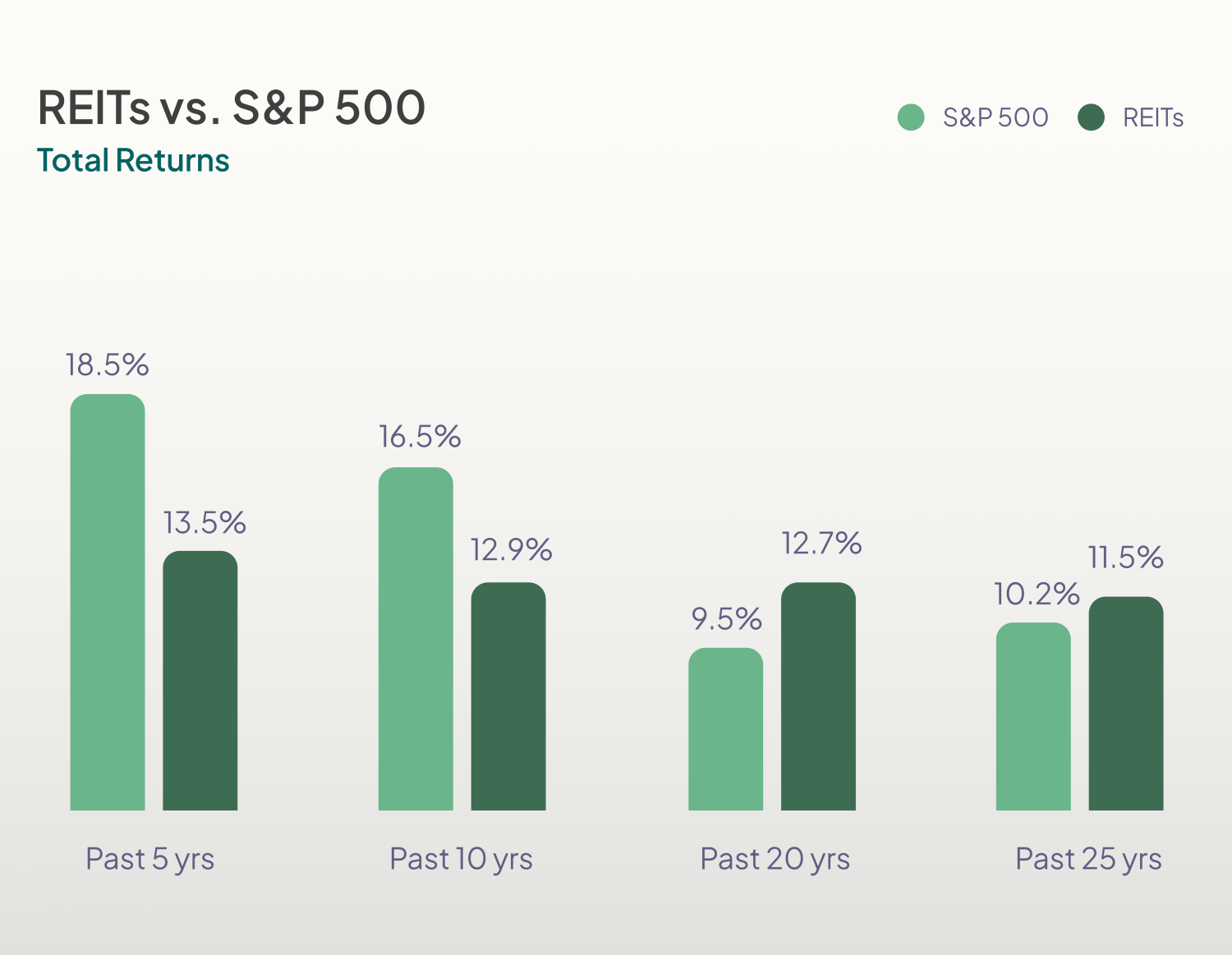

Is Roots a REIT?

Roots is a Reg A+ REIT. With a REIT, you can see returns both through the income generated by the properties you put money into and through the property’s value growing over time. All REITs are required to distribute 90% of its profit to shareholders. Some REITs pay you money regularly like Roots (in the form of dividends) and they allow you to spread your investment across several different properties, which lowers your risk. You can learn all about the world of REITs here >>

What markets are Roots properties in?

Roots is a portfolio of residential rental properties located in the greater Atlanta market. There are many reasons Atlanta is a great market for residential real estate investing, but the top three are: its population growth, its diverse economy, and the role that the film and television industry is having on people and industry moving into the city. You can learn more about the Atlanta real estate market here >>

How would Roots be affected by an economic downturn or commercial crash?

Although we don't have a crystal ball, we have incorporated some unique attributes to the Roots model and strategy that makes the fund extremely defensible in case of a downturn:

- • Purchase Timing: Buying properties now, with cash, under market rates

- • Property Type: SFR and small multi family (not commercial), all workforce housing

- • Location: greater Atlanta market (a top market).

- • Live In It Like You Own It™: aligns incentives of residents and investors.

- • Debt ratio: Low leverage

You can read more about this here >>