When looking to diversify your investment portfolio, real estate is one of the best options, but it isn’t always easy to get started.

Finding the right place to invest can be a challenge, but companies like Arrived Homes, Groundfloor, and Roots make real estate investment accessible to everyone with transparent platforms that are both easy to use and easy to understand. At the end of the day, it’s up to the investors to determine what is best for their current situation.

If you’re looking for more flexibility in your investments, Arrived may suit you best as you can purchase fractional investments in residential or vacation rental homes, invest in real estate debt, or invest in a portfolio of residential properties.

Groundfloor offers a platform to both borrow money to flip and renovate homes as well as the opportunity to invest in these property loans (debt) and receive monthly interest payments, making it a good option if you’re looking for a short-term (6-24 months) investment.

If you’re interested in a residential-focused real estate portfolio with low fees and minimum investment, and a fund that has a one-of-a-kind social impact on its renters, Roots is for you.

Arrived Homes, Groundfloor, and Roots all offer great ways to invest in real estate without the hurdles of things like property management or rent collection.

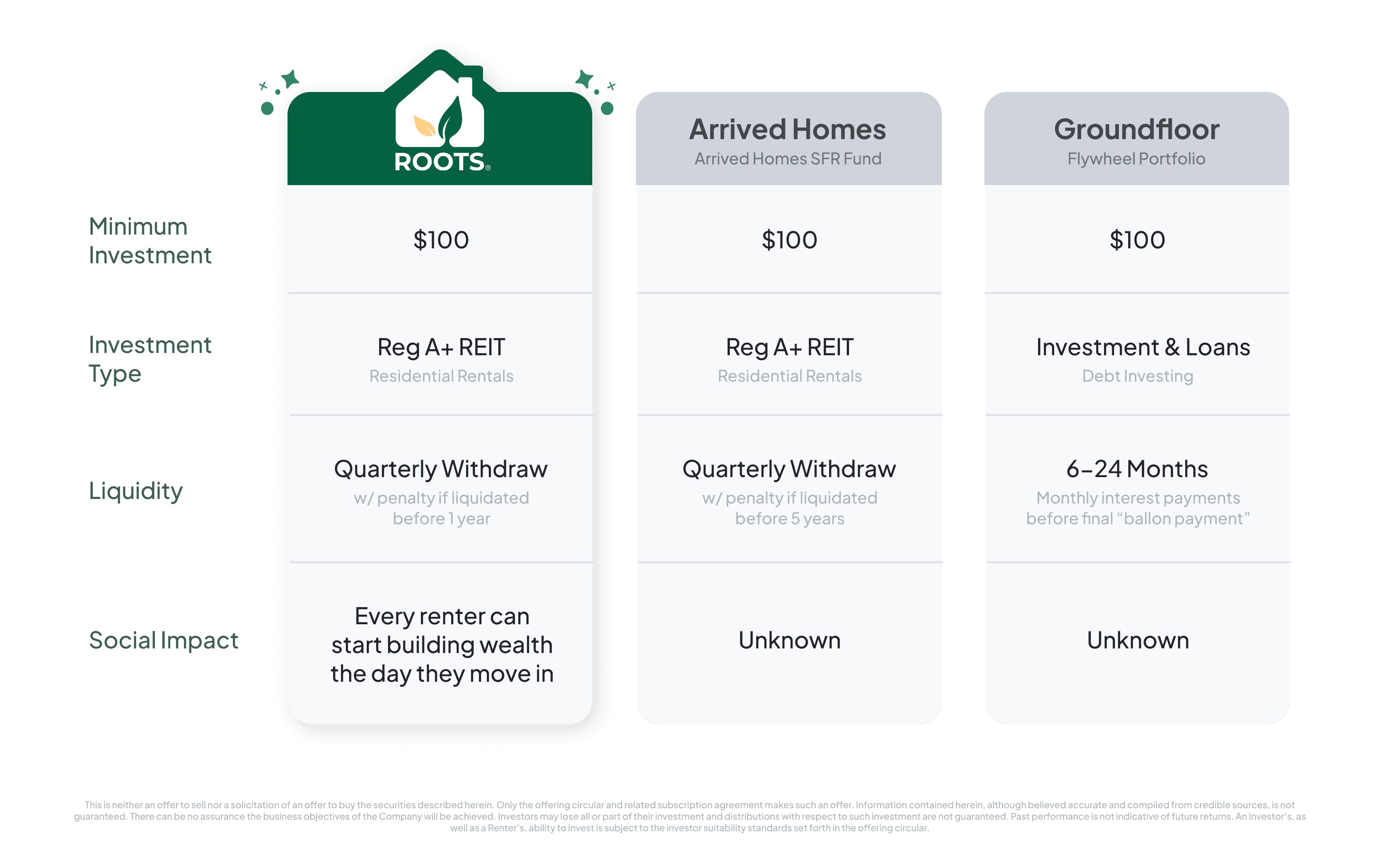

Below you'll find an in-depth breakdown of Roots, Arrived's Single Family Residential Fund, and Groundfloor's Flywheel portfolio, highlighting their differences across 4 dimensions: investment type, minimums, liquidity, and social impact.

Property Type

Roots

Roots' REIT offers a portfolio of residential properties focused on the workforce housing segment, currently in Atlanta and Augusta, GA, with expansion plans across the Southeast. Roots has a unique model where the renters of the properties have the opportunity to be invested in the fund if they are good renters (paying rent on time, taking care of the property, and being good neighbors). This has led to low vacancy, low turn costs, and high returns for its investors, as you’ll see below.

Arrived Homes

Arrived offers four ways to invest: you can purchase a fractional share of a vacation rental, or a regular single-family rental property, you can purchase real estate debt, or you can invest in the Single Family Residential Fund, which will be the focus of this article.

Groundfloor

Groundfloor offers investments and loans for residential properties in need of renovation and fix-up. You can choose to invest in a single property or in a portfolio of loans, like the Groundfloor Flywheel Portfolio, which is a collection of 200 – 400 short-term real estate loans. It’s important to note that an investment is an investment in debt, not in property equity. Once the renovations are made, ideally, the investor is paid back with interest.

Minimum Investments, Fees & Liquidity

Roots

Roots allows you to invest with a $100 minimum. Roots has a low fee structure, with only a $5 transaction fee per investment and a $3 transaction fee on any recurring investment. With Roots+, there are no transaction fees, so more of your money goes to work. If you need to liquidate your funds within one year, there is an 8% early withdrawal penalty, but after one year, there are no penalties to withdraw.

Roots distributes profits to investors quarterly, providing investors the option to reinvest or cash out their distributions at that point in time. Roots offers the ability to liquidate quarterly as well, $100k or up to 5% of the fund.

Arrived Homes

Arrived's Single Family Residential Fund allows investors to start investing with a $100 minimum. It has a management fee of 0.25% of net assets per quarter and other potential fees, which may include but are not limited to closing costs, offering costs, property renovations, sourcing fees, holding costs, operating expenses, and more. These investments are positioned as longer-term investments with a six-month holding period on withdrawals. For those who are looking to liquidate earlier than 5 years, there is a 1-2% cost associated with doing that.

Groundfloor

Groundfloor requires a $100 minimum investment to get started, and like Arrived Homes and Roots, it's open to accredited and non-accredited investors. Investments in the Groundfloor Flywheel Portfolio have a fee of 1% when capital is repaid. With the varying maturity dates of the assets in the portfolio, it can take from 6-24 months for all the assets within the portfolio to mature and have the payments collected at any given time.

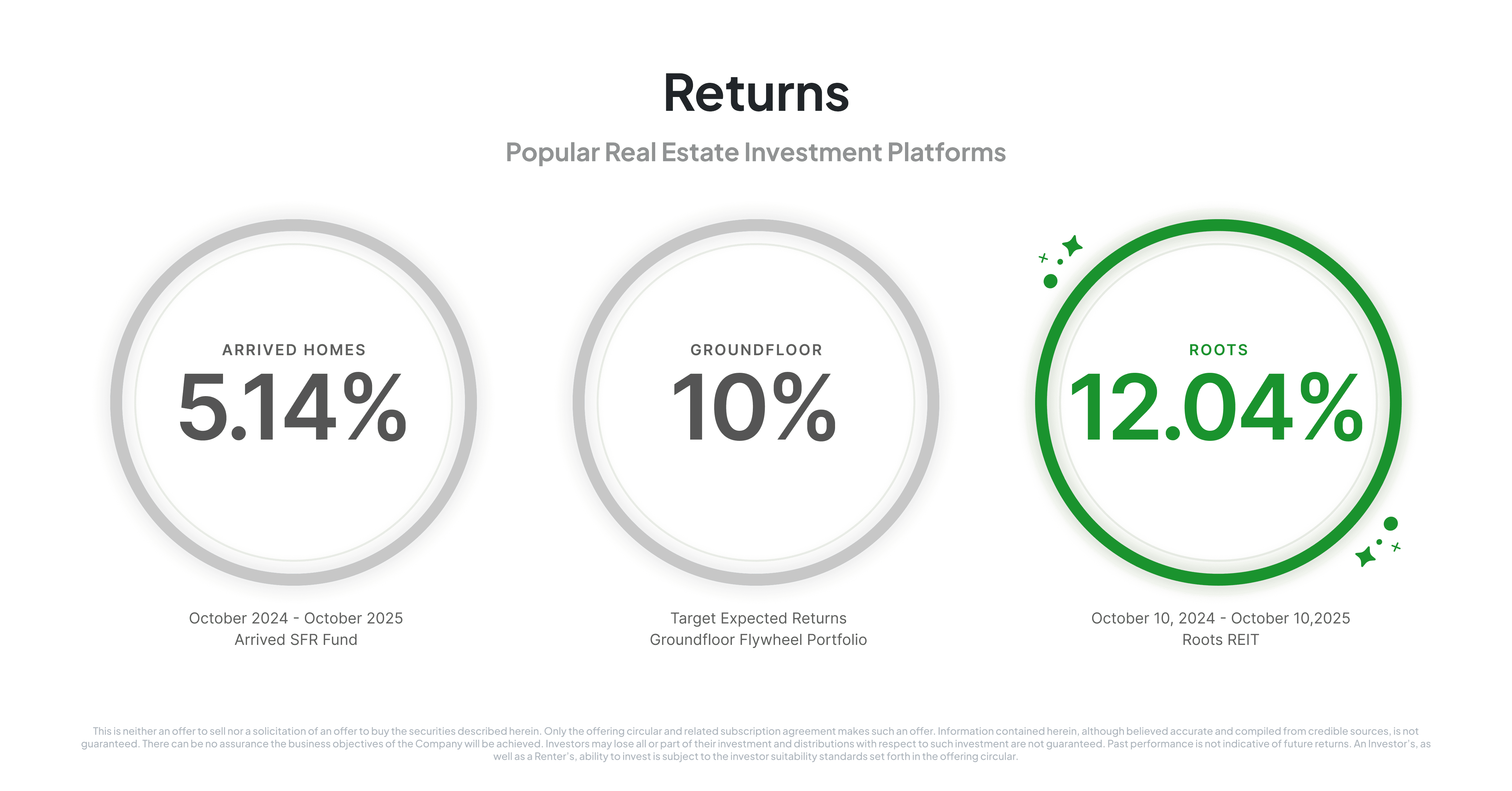

Performance

Roots

Roots targets annual returns of 12–15%. It has met or exceeded this goal every year, delivering a 12.04% return over the past year (October 10, 2024 – October 10, 2025) and an average annual return of 17.81% since inception (October 1, 2021 – October 10, 2025). Dive into Roots' historical performance here.

Arrived

Arrived’s Single Family Residential Fund has returned 5.14% over the last 12 months (October 2024 ‑ October 2025).

Groundfloor

While Groundfloor has not disclosed the portfolio's trailing 12-month performance, the Flywheel portfolio offers investors an expected annual return of 10%.

Even though historically all three companies have delivered returns to investors, it’s important to remember that past results do not determine future success. Risks are always present when investing your money, so it’s important to understand what those risks are before making your first investment.

Ready To Get Started? Invest With Roots

Imagine owning real estate where your renters want it to succeed as much as you do.

Start investing with as little as $100, and own a piece of the only real estate fund that creates wealth for both its investors and its renters. It took us years to build Roots, but you can invest in as little as 5 minutes.

Sources

The Roots Logo® are trademarks of Seed InvestCo, LLC. All other trademarks shown are the property of their respective owners.