Real estate investment trusts (REITs) are a great option for investors seeking real estate exposure without the challenges of directly owning and managing properties.

REITs pool investor money to purchase and manage real estate, offering profits in the form of dividends or appreciation, much like owning stocks. But not all REITs are the same.

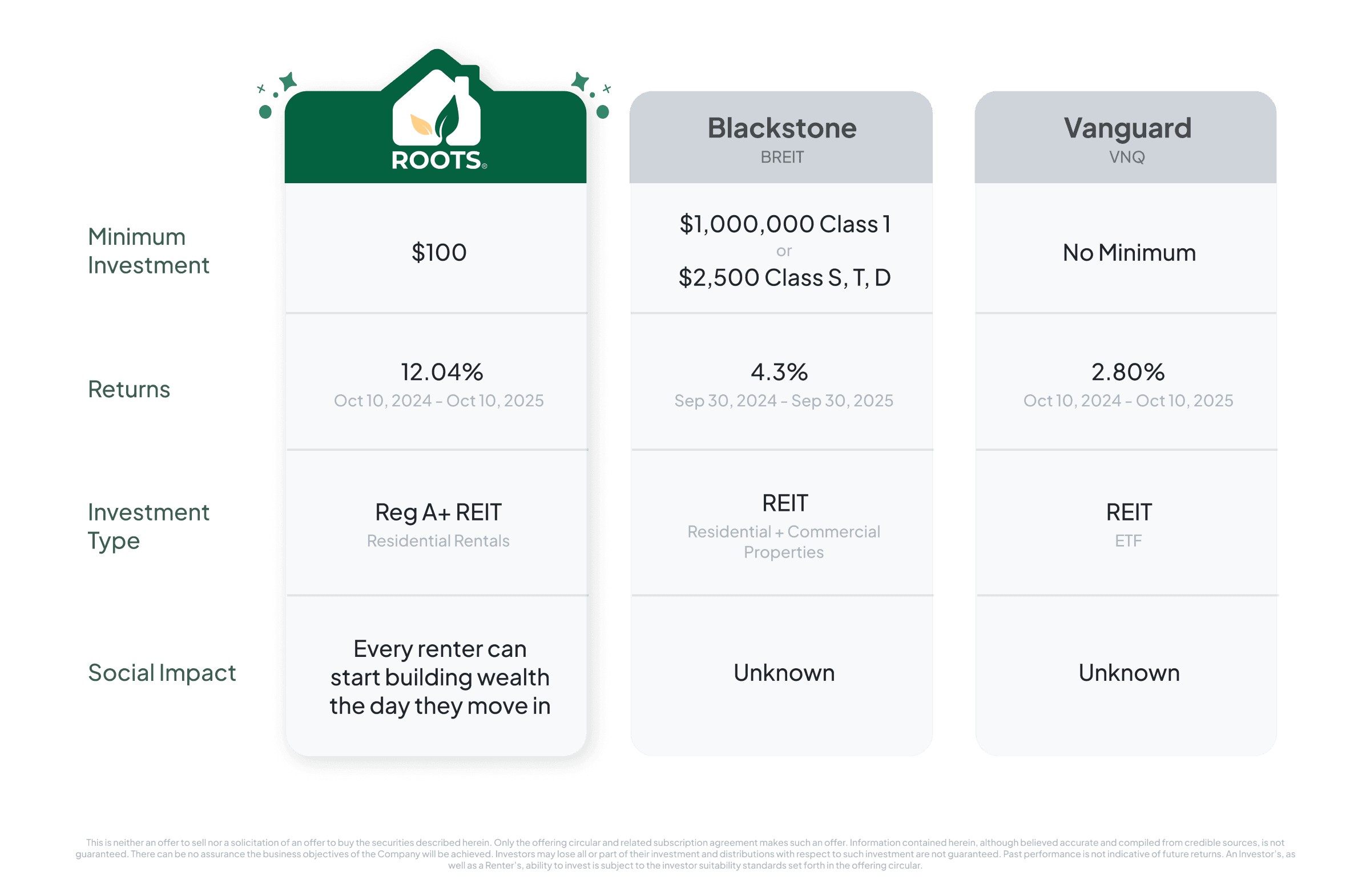

If you are looking for a private REIT with low fees, a low minimum, and to invest in real estate that has a unique, positive social impact on the renters, Roots is for you.

If you’re looking for a Non-Listed REIT, are an experienced investor, have the time to coordinate with a financial advisor, and want to allocate a large amount of resources to bet on a REIT, BlackStone’s BREIT may be the right one for you.

If you’re looking for a publicly traded REIT that is easy to purchase on stock exchanges and are comfortable with the daily volatility of its share price, Vanguard’s VNQ may be for you.

Below you’ll find a breakdown of Roots’ REIT, Blackstone’s BREIT, and Vanguard’s VNQ ETF, highlighting their differences across minimums, returns, investment type, and social impact.

Investment Type

Roots

Roots is a private REIT offering a portfolio of single and multi-family residential rental properties, currently in the greater Atlanta area and just outside Augusta, Georgia. Roots focuses on workforce housing and has a unique model in which renters of Roots' properties have the opportunity to be invested in the fund for being good renters, creating a partnership between the company's renters and investors. By simply paying rent on time, taking care of their property, and being a respectful neighbor, a Roots renter can gain tangible equity in the fund, something that's incredibly rare to find in a country where one in four Americans have less than $1,000 in savings.

This model has led to low vacancy, low turnover costs, and historically high returns for its investors, all while giving people from all walks of life the opportunity to build wealth while renting.

Blackstone's BREIT

Blackstone's BREIT allows individual investors to invest in institutional-grade commercial properties, typically only available to large institutions. BREIT's portfolio is concentrated in high-growth sectors, including data centers, warehouses, student housing, and the fast-growing Sunbelt market.

BREIT is one of the largest owners of student housing in the United States and also owns QTS, one of the world's fastest-growing data center companies. BREIT also invests in multi-family, single-family, and affordable housing.

Vanguard VNQ

Vanguard's VNQ is a publicly traded ETF that invests in REIT stocks across a range of sectors, including office buildings, warehouses, telecom infrastructure, and multifamily housing. This gives VNQ a diversified portfolio, reducing vulnerability to single-sector downturns. However, because VNQ is publicly traded, its value fluctuates with market sentiment.

Minimum Investment, Fees, and Liquidity

Roots

Roots allows you to invest with a $100 minimum. With no assets under management (AUM) fees, Roots has a low fee structure, with only a $5 transaction fee per investment and a $3 transaction fee on any recurring investment. With Roots+, there are no transaction fees, so even more of your money goes to work.

If you need to liquidate your funds within one year, there is an 8% early withdrawal penalty, but after one year, there are no penalties to withdraw. Roots has historically distributed to investors every quarter, and investors have the option to reinvest or cash out their distributions at that point in time. Investors can withdraw up to $100,000 of their investment on a quarterly basis.

Blackstone BREIT

Blackstone allows you to invest with a $2,500 minimum for their Class D, S, and T shares and a $1,000,000 minimum investment for their Class I shares. Unlike the other REITs mentioned in this article, Blackstone is open to investors based on a minimum income requirement of $70,000 annually or a net worth of at least $250,000.

Blackstone offers monthly distributions for the BREIT but cautions investors that these are not guaranteed. They have a limited number of repurchases that they choose to make each month or quarter and can potentially choose to repurchase none of the submitted shares.

Blackstone has a 1.25% management fee, a stockholder servicing fee, a selling commission fee, and a high-performance fee.

Vanguard (VNQ)

Vanguard's VNQ, being a publicly traded ETF, has no minimum investment beyond the cost of a single share. Its annual management fee is 0.13%, making it one of the cheapest options for real estate exposure. VNQ also offers quarterly distributions, with liquidity as easy as buying or selling shares on the stock exchange.

Returns

Roots

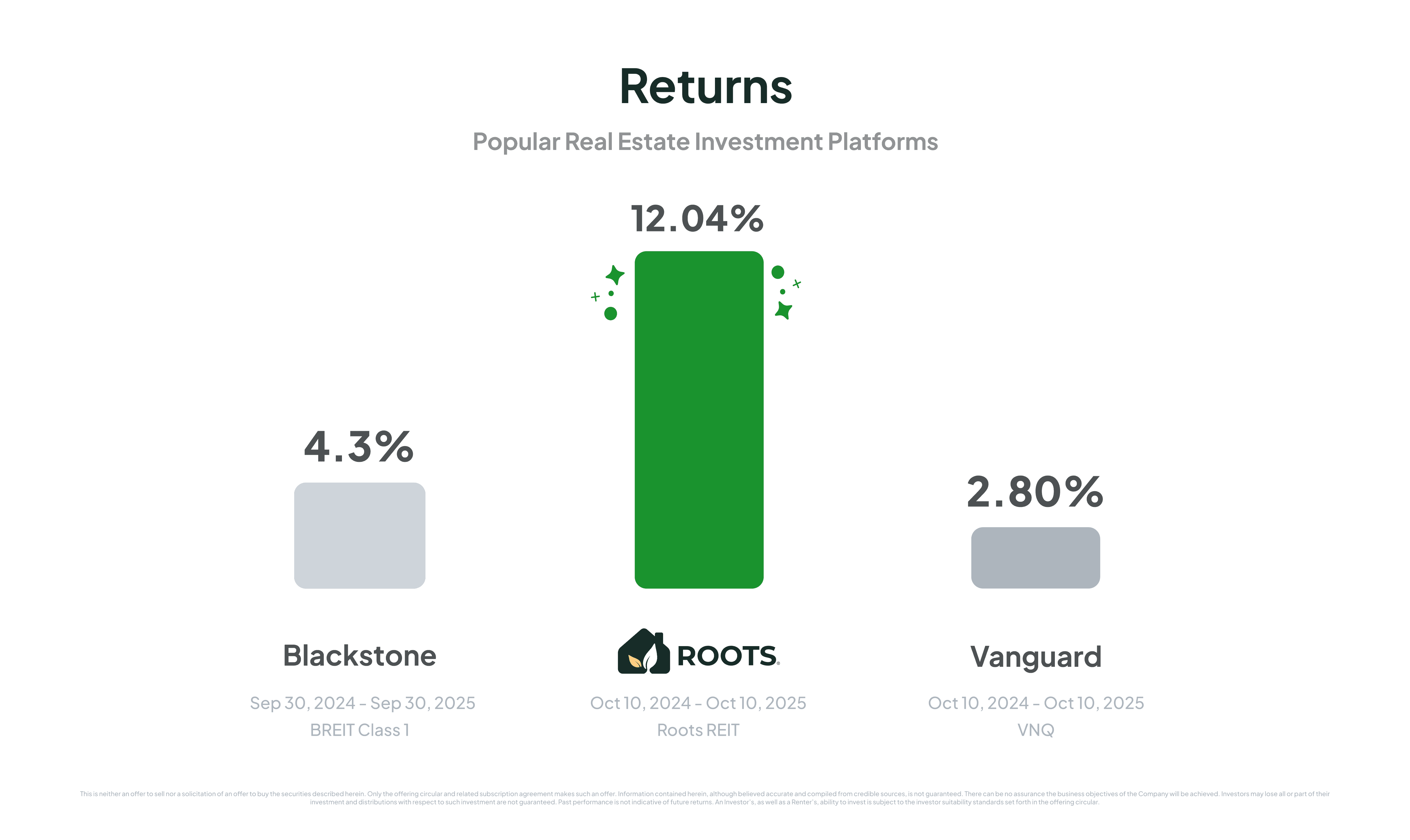

Roots targets annual returns of 12–15%. It has met or exceeded this goal every year, delivering a 12.04% return over the past year (October 10, 2024 – October 10, 2025) and an average annual return of 17.18% since inception (July 1, 2021 – October 10, 2025). The fund also distributed $905,276.68 to investors in the second quarter of 2025. Dive into Roots' historical performance here.

Blackstone BREIT

Blackstone reports an annualized net return of 9.2% since BREIT's inception in 2017, which is higher than the average publicly traded REIT during this timeframe. While it has been historically dependable, BREIT had returned just 4.3% from September 30, 2024 - September 30, 2025.

Vanguard (VNQ)

VNQ seeks to provide high-income and moderate long-term capital appreciation by closely tracking the MSCI US Investable Market Real Estate 25/50 Index. This index measures the performance of publicly traded equity REITs and other real estate-related investments in the United States. Over the last 12 months, it delivered a 2.80% return to investors (October 10, 2024 - October 10, 2025).

Even though historically all three companies have delivered returns to investors, it’s important to remember that past results do not determine future success. Risks are always present when investing your money, so it’s important to understand what those risks are before making your first investment.

Ready To Get Started? Invest With Roots

Imagine owning real estate where your renters want it to succeed as much as you do.

Start investing with as little as $100, and you can join the thousands across America that are investing with Roots, the only REIT that gives investors and its renters the opportunity to grow wealth together. With Roots’ “win-win” model, you can increase passive income, save for retirement, and grow your wealth. All while helping the renters grow theirs.