Tour Roots, Fundrise, and RealtyMogul: Top Real Estate Platforms for 2024

When looking to diversify your investment portfolio, real estate is one of the best options available, but it isn’t always easy to get started. Finding the right place to invest can be a challenge, but Fundrise, RealtyMogul, and Roots make real estate investment easy with transparent online platforms that are both easy to use and easy to understand.

Fundrise may be the best option if you’re looking for the most property types.

RealtyMogul may be the best option if you’re looking to focus your investments on the commercial sector.

Roots may be the best choice for you if you’re interested in a residential focused real estate portfolio with fewer fees, a low minimum investment, and a fund that has a one-of-a-kind social impact on its renters.

Fundrise, RealtyMogul, and Roots all offer great ways to invest in real estate without the hurdles of things like property management or rent collection.

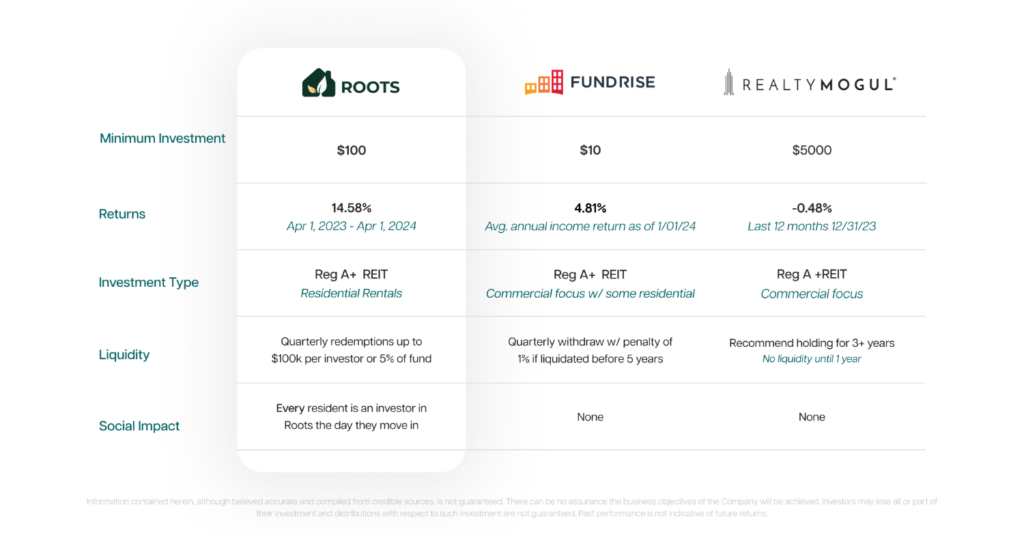

Below you'll find an in-depth review of Roots, Fundrise, and RealtyMogul, highlighting their differences across 5 dimensions: property type, minimums, fees, liquidity and average returns.

Property Type

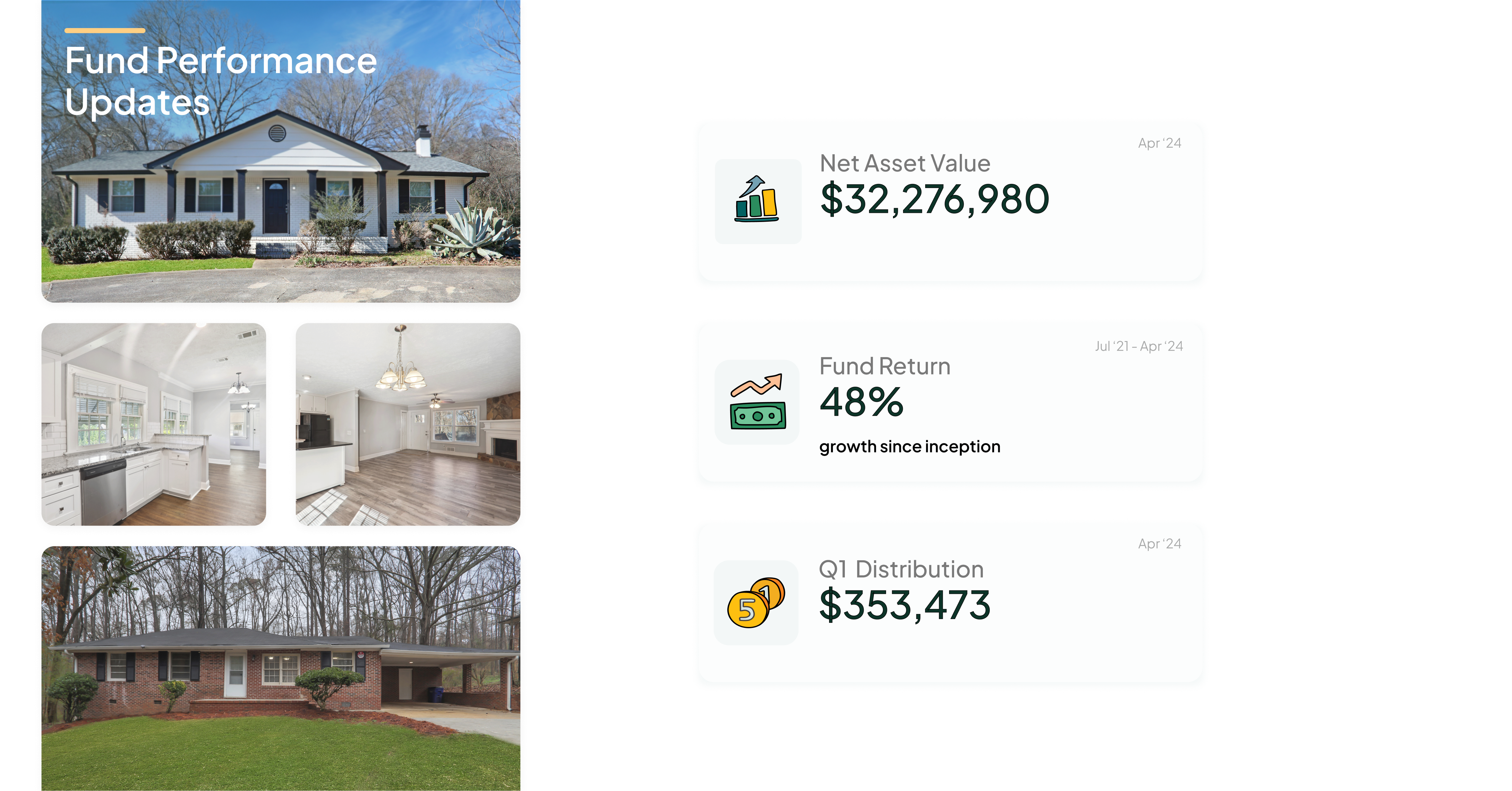

Roots

Roots offers a portfolio of residential rental properties, including single and small multifamily. Roots has a unique model where the residents of the properties get invested in the fund if they are good renters (pay rent on time, take care of the property, and are a good neighbor). This has led to less vacancy, lower turn costs, and higher returns for its investors, as you’ll see below.

Fundrise

Fundrise offers three property types: multifamily apartments, industrial properties, and single-family rentals. Similar to Roots and RealtyMogul, these properties are offered in electronic real estate investment trusts (eREITs), mirroring traditional REITs, but accessible through an online platform.

RealtyMogul

RealtyMogul offers a variety of investment opportunities in the commercial real estate sector, which includes multi-family buildings, retail centers, and properties in ground-up development across dozens of markets in the United States.

Minimum Investments, Fees & Liquidity

Roots

Roots allows you to invest with a $100 minimum. Unlike Fundrise and RealtyMogul, Roots has a lower fee structure, with only a $5 transaction fee for your first investment and a $3 transaction fee on any recurring investment. If you need to liquidate your investment before one year, there is a 6% early withdrawal fee, but other than that there are no fees to investors.

Roots distributes to investors quarterly, providing investors the option to reinvest or cash out their distributions at that point in time. Roots offer the ability to liquidate quarterly as well, $100k or up to 5% of the fund.

Fundrise

With Fundrise, you can start with as little as $10, and they charge a 1% annual asset management fee, a 0.15% annual advisory fee, and a 0.85% annual investment fee. It’s also important to note that Fundrise is intended to be a long-term, illiquid investment. They offer the ability to withdraw your investment at the beginning of each quarter, but there is an approximate penalty of 1% of your total share value if it’s liquidated before 5 years.

RealtyMogul

RealtyMogul has the highest minimum investment of these three REITs at $5,000. RealtyMogul offers distributions to their investors in the form of monthly dividends and have gone eighty-five months with consecutive distribution periods.

RealtyMogul charges management fees of 1-1.25%. It is important to note that investments in RealtyMogul are intended to be a long-term illiquid investments, however you can sell your shares back after you've owned them for one year.

Performance

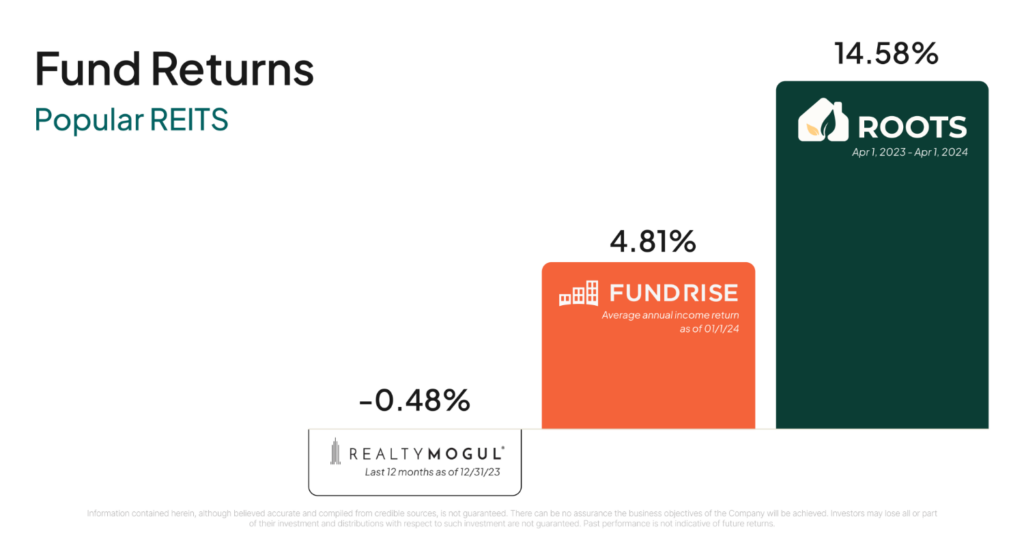

All platforms have delivered returns to their investors with Roots leading the way.

Roots returned 14.58% from April 1, 2023 - April 1, 2024 and has returned 48% from July 1, 2021- April 1, 2024.

Fundrise boasts an average income return of 4.81%.

RealtyMogul Income REIT returned -0.48% in 2023.

Even though historically all three REITs have delivered returns to investors, it’s important to remember that past results do not determine future success. Risks are always present when investing your money, so it’s important to understand what those risks are before making your first investment.

Ready To Get Started? Invest With Roots

Start InvestingImagine owning real estate where your renters wanted it to succeed as much as you do.

Start investing with as little as $100, and own a piece of the only REIT that creates wealth for both its investors and its residents. It took us years to build Roots, but you can invest in as little as 5 minutes.

Sources