What is a REIT?

“REIT” (rhymes with sheet) stands for Real Estate Investment Trust, and simply put, it’s a way for anyone to become an investor in real estate. A REIT is a company that owns properties across different real estate sectors – from railroads to residential – and makes it as easy to invest in real estate as it is to invest in stocks – maybe even easier! In the same way that you can invest money in a company by purchasing their stock, you can purchase shares of property through a REIT. With Roots, you can get started for only $100.

As a total return investment, REITs share the money made by the properties with all the shareholders in the form of dividends, allowing everyone to be a part of the rewards. And as the value of the property appreciates over time, and so the initial investment does, too!

Why were REITs created?

Real estate has always been a very lucrative investment, but before REITs, investing in property required a ton of money and a whole lot of knowledge and connections. That all changed in 1960, when President Dwight D. Eisenhower signed a new law that combined the ease of stock investment with the allure of real estate.

With REITs, any person has the capability to become an investor in real estate without putting up their life savings, the connections to find good deals, or needing to spend all of their time managing the property. Instead, you can own a small piece of a real estate portfolio, for a small price (just $100 with Roots!) and never have to worry about handling things like building maintenance, repairs, or going to industry networking events.

How does a REIT with rental properties work?

As previously stated, a REIT works a lot like a stock investment. The first step is purchasing shares of the REIT, making you a beneficiary of growth of the REIT, including profits from rental income and the property appreciation. Next, the managers of the REIT purchase properties and lease them to tenants. Those managers then handle the rent collection and overall care for the property, alleviating the burden from you, the investor. Finally, the REIT distributes the profits to shareholders after handling expenses. REITs must distribute 90% of profits to investors, and they come in the form of dividends with the option to reinvest them into the fund, growing your ownership even further! For example, Roots distributes profits quarterly, and keeps investments liquid for investors.

What are the advantages of a REIT?

Of the many advantages of REITs, there are five big ones that you should know about: returns, diversification, performance, popularity, and transparency.

REIT Returns

With a REIT, you can see returns both through the income generated by the properties you put money into and through the property’s value growing over time. All REITs are required to distribute 90% of its profit to shareholders. Some REITs pay you money regularly (in the form of dividends) which is basically like getting a paycheck through real estate.

REIT Diversification

REITs don’t make you put all your eggs in one basket. Instead of having to put a ton of money into one property, REITs allow you to spread your investment across several different properties, which lowers the risk for you, the shareholder. For example, Roots REIT has 114 properties, all single family and small multi family.

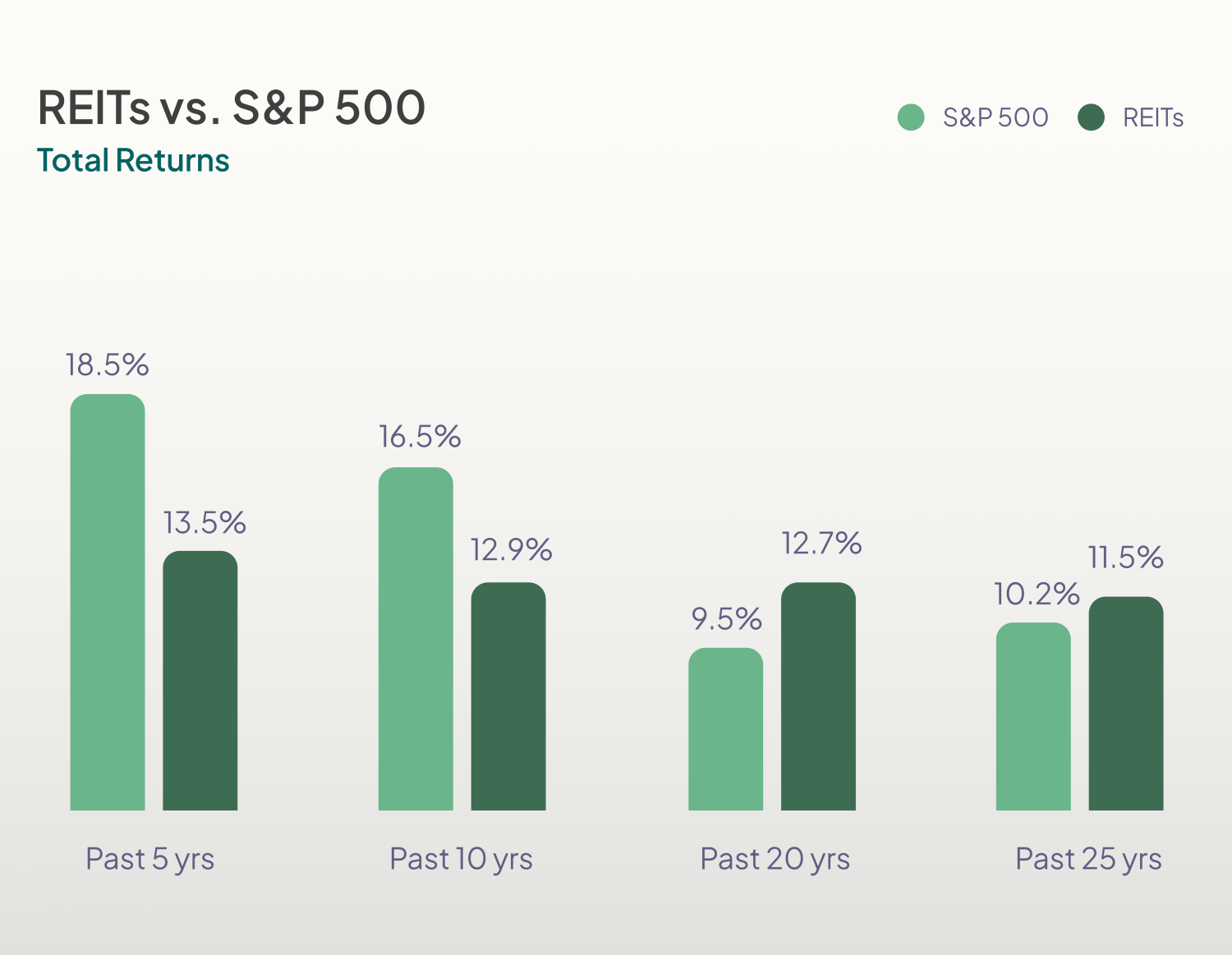

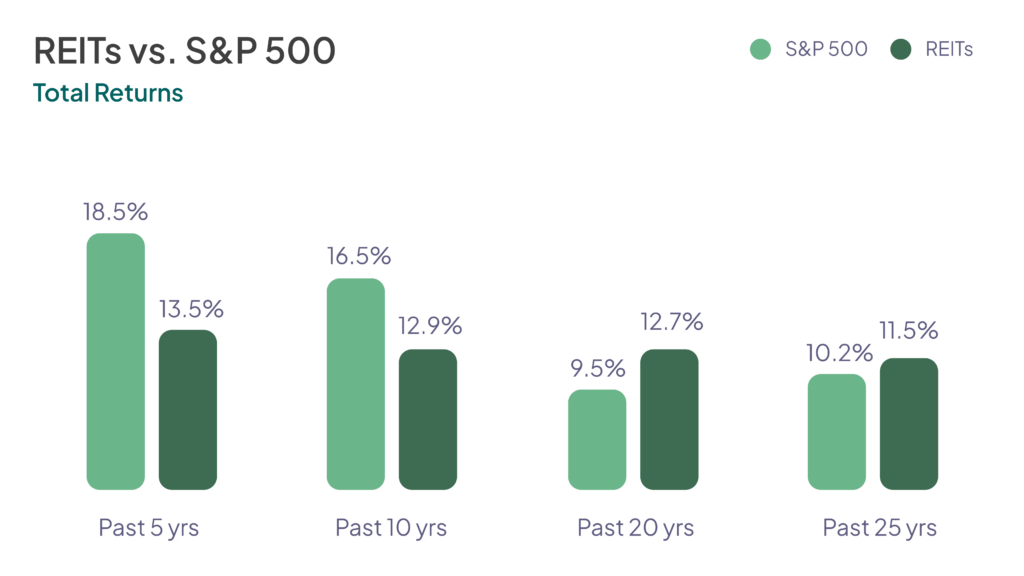

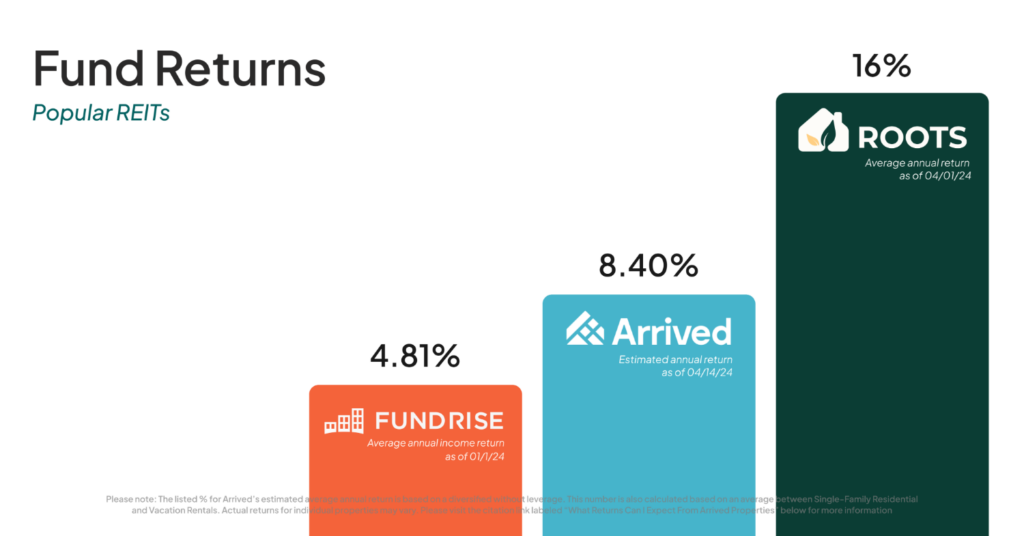

REIT Performance

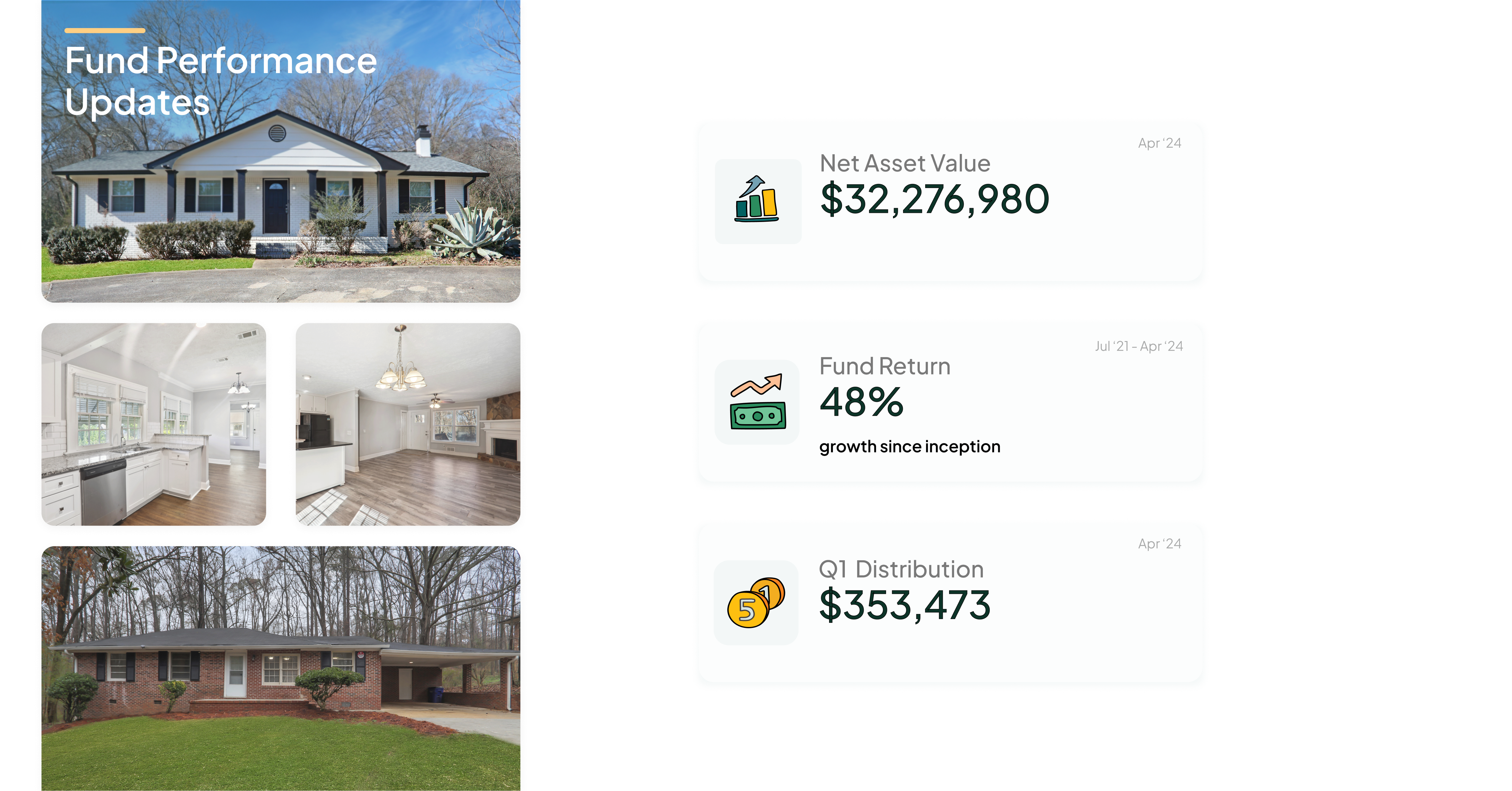

REITs are a great way to generate future financial security. Over the last twenty-five years, REITs have outperformed the S&P 500 and other corporate bonds, meaning that REITs are awesome long-term investments. For reference, Roots has returned 48% from July 1, 2021 - April 1, 2024.

REIT Popularity

A REIT is like sunshine: everybody loves it. Over 150 million Americans live in houses that are in REITs either directly or through another investment fund.

REIT Transparency

REITs are easy because they don’t hide anything – they’re open books! They tell you exactly how much they’re making, what properties they own, and how it’s all managed, which means that if you want to know what’s happening with your investment, all you need to do is look.

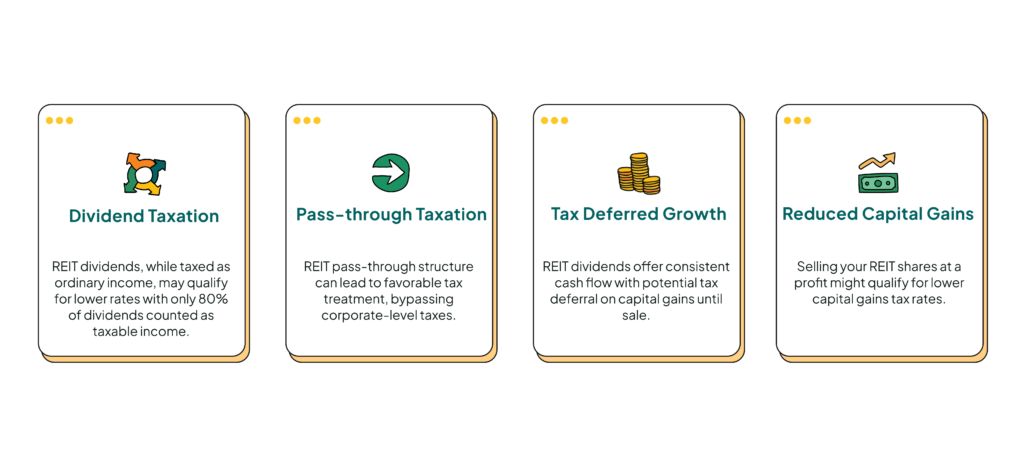

REIT Tax Advantages

Because REITs share the majority of their profits with their shareholders, they don’t have to pay corporate taxes. The money made is treated as capital gains, and the individual shareholder (that’s you!) can deduct up to 20% of the income you receive through your dividends with no cap and no restrictions on wages.

Public vs. Private REITs: What to Look for When Selecting a REIT

REITs can be both public and private, and while the function of investing in either comes from the same place, there are some important differences between the two. Daniel Dorfman, the co-founder and CEO of Roots REIT, recently broke down the pros and cons of both public and private REITS in a Roots Informational Webinar.

Why Roots REIT?

Roots is the only REIT that grows wealth for both you and its residents, leading to a win-win partnership that delivers better returns. Here's how the model works:

- You invest in the Roots REIT

- Roots buys properties, fixes them up, and rents them

- Renters get invested in the fund for paying on time, taking care of the property, and being good neighbors

The model is working, with the fund up 48% from July 1, 2021 - April 1, 2024.

It’s only $100 to get started and your investment isn’t tied up for years and years on end - Roots offers liquidity every quarter.

It took years to build Roots. But you can start investing in just five minutes.