5 Reasons Investing in a REIT is Better Than Purchasing an Investment Property

What is a REIT?

A Real Estate Investment Trust (commonly referred to as a "REIT") is a company that owns properties across different kinds of real estate sectors and allows investors to acquire ownership in a diversified portfolio of real estate with the ease of investing in a stock.

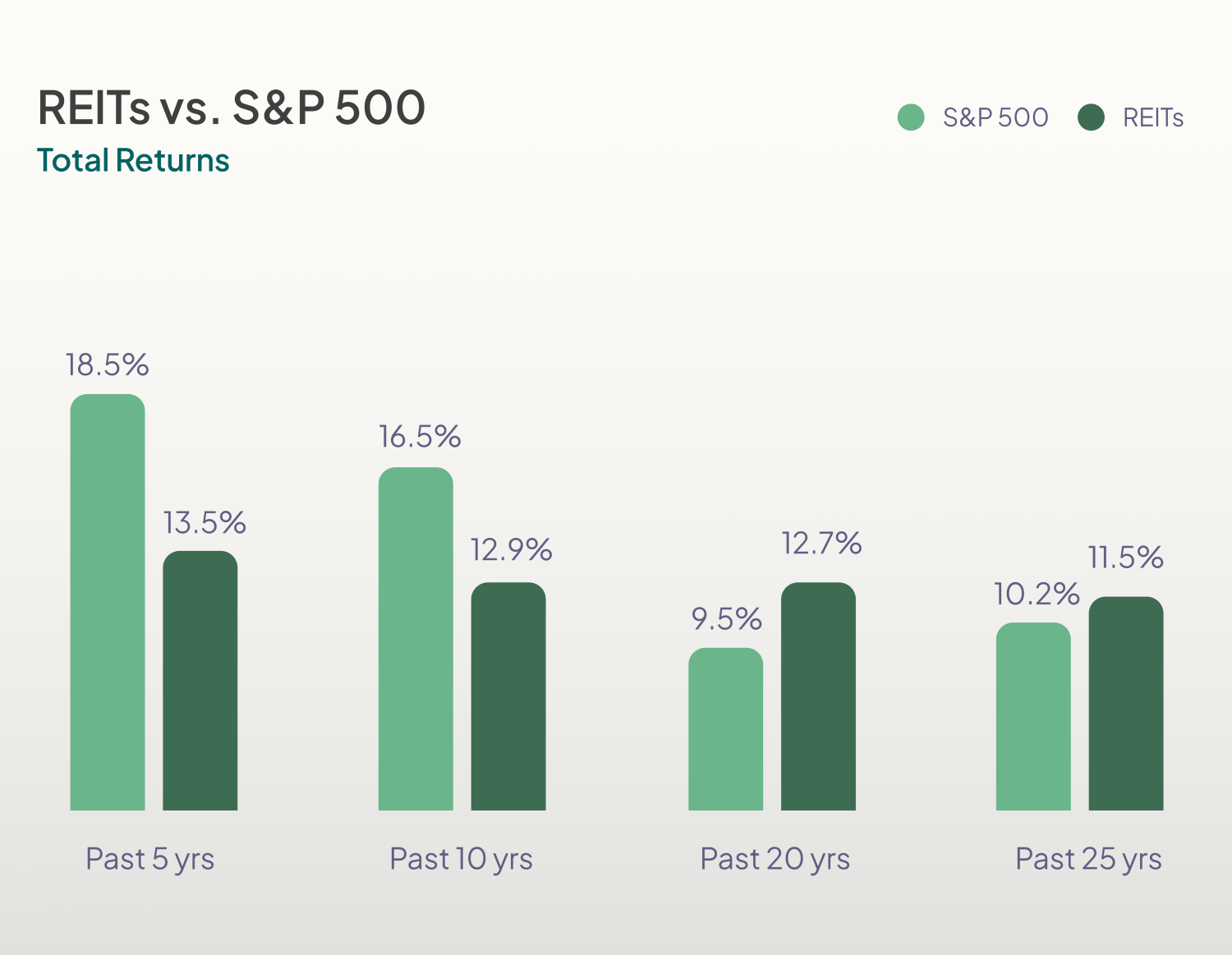

Though they can range in property type, availability, and investment minimums, REITs offer the opportunity to invest in all types of real estate – from railroads, to rentals, and retail centers – in the form of shares of property. REITs are a total return investment, which means they share the money made by the properties with all the shareholders in the form of dividends, as the initial investment can continue to grow along with the value of the properties.

Why were REITs created?

In 1960, President Dwight D. Eisenhower signed the Cigar Excise Tax Extension, which made mechanical lighters more expensive and, more importantly, gave way to REITs. Also known as the REIT Act, Eisenhower's signature changed real estate forever. Newly created "REITs" allowed investors to invest in large-scale, income-producing commercial real estate. The lucrative nature of real estate investing had always existed, but until 1960, it required full investment in a property, the knowledge needed to manage properties, and the time to manage them.

With the inception of REITs, everyone became eligible to invest in real estate without having to leverage their savings and commit to managing a property. For the first time, the middle class could own a sliver of something tangible for a low price and no upkeep. Through the years, REITs have grown to include all real estate sectors, whether commercial, non-commercial, or mixed. For example, Roots REIT is comprised of residential rentals across the greater Atlanta market.

How does a REIT work?

An investment with a REIT is very similar to an investment in a stock. An investor purchases shares of a REIT, making them a beneficiary of the investment, which gives them access to income generated by rent and the property value's appreciation. After investing, there is little else to do, as the managers of the REIT handle the property purchasing and leasing to qualified tenants, as well as collecting the rent and the overall maintenance and care for the properties.

With REIT managers focused on the day-to-day care and supervision of the properties, the investor's only next step is to receive the distribution of profits after the REIT has covered any necessary expenses. REITs must distribute at least 90% of their profits to investors, typically in dividends distributed at varying frequencies, such as monthly, quarterly, etc. For example, Roots distributes profits quarterly.

Why is a REIT better than purchasing your own rental property?

REITs are a great way to get into real estate investing. Still, you may be wondering: Why is investing in a REIT more advantageous than investing in your own real estate rental property, one where you would be the sole owner and receive all profits?

A REIT investment offers five distinct advantages to an investor: diversification, access to deals, savings, income generation, and property management.

Diversification

Imagine you own one investment property, and in spite of your work to keep the property running smoothly, a leak floods the basement. That one leak could lead to the unit not being rented for a long period of time and a lot of money to repair the damage, ruining your investment for the short-term (if not longer).

Now, instead of having full ownership of one property, imagine being invested in a portfolio of 100+ properties. A leak flooding the basement of one of those properties is still something you hope doesn't happen, but if it ever does, you have enough diversification across other properties so that one incident doesn't ruin your investment.

REITs allow you to spread your investment across several different properties, lowering the risk for you, the shareholder. REITs don't make you put all your eggs in one basket – they're diversification without the sweat.

Access to deals

REITs offer easy access to a comprehensive catalog of properties to invest in. There's no need to grow an extensive real estate network and be in the know about every significant deal to get ahead as there is in finding, purchasing and owning your own properties. Instead, REITs give you full access to their best offerings. For example, Roots founders have spent well over a decade building an extensive real estate network - all you have to do is invest.

Cash Savings

Though some REITs require a substantial minimum investment, there are many affordable options, allowing investors to save their money and not have to worry about things like large down payments, rate increases, remodeling costs, repair costs, or general upkeep costs. For example, you can invest with Roots for as little as $100.

Income generation

Though you won't receive the total income created by one property as you would if you owned it, there is still substantial income generation through REIT investments in the form of distributions from rental income profits. Remember that REITs must distribute 90% of their profits to their shareholders, meaning the vast majority of profit made through these properties goes to investors. For example, Roots distributes profits quarterly to its investors.

Property management

When you become a shareholder in a REIT, the REIT managers handle property management, which spares you, the investor, from all the hassle (including those leaks..).

Ready To Get Start investing in a REIT? Invest With Roots

Start InvestingRoots is the only REIT that creates wealth for its investors and residents.

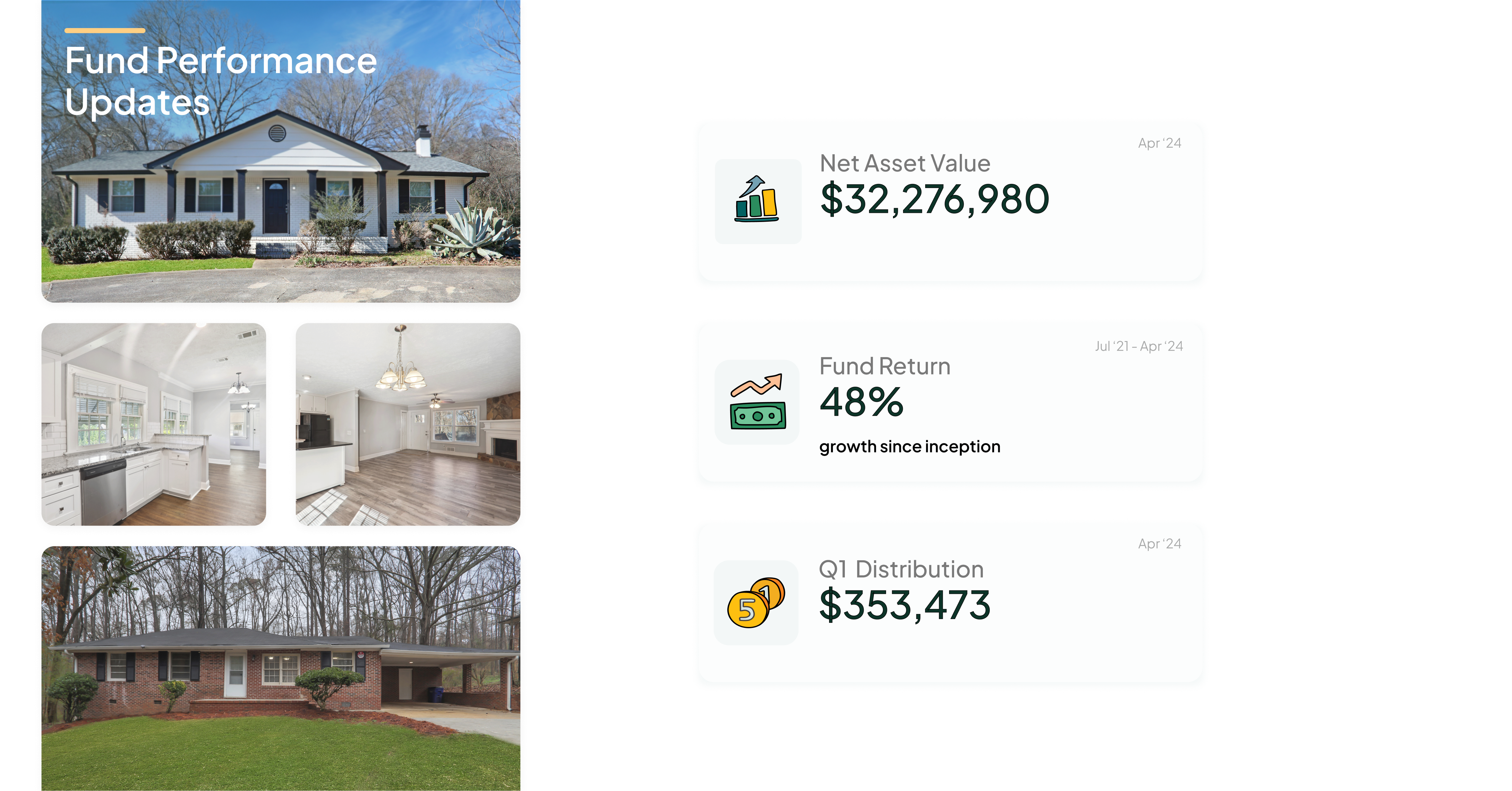

Roots is revolutionizing the “tenant-landlord” relationship, delivering historic annual returns of 16%, and helping its residents save and invest over $465k.

Here's how it works:

- You Invest with Roots with as little as $100.

- Roots acquires and manages the properties, and finds residents.

- Residents build equity when they pay rent on time and take care of the property.

…Which lowers turnover costs, minimizes vacancies, and creates solid returns for all. Over $29 million has been invested from over 4,500 investors— Grow your wealth while helping the residents grow theirs.