A Recession and Pending Commercial Real Estate Crash: What it Means for Roots

Over the past year, economists have debated the possibility of a recession occurring in 2024, and while some feel that we may have survived it, the New York Fed maintains a 56% possibility of a recession. High-interest rates, debts, and uneven job data, however, point to the possibility that a recession may only have been delayed, while indicators from the commercial real estate market signal a pending crash that would connect directly to a recession. These concerns aren’t only conversations being had by economists, though. Many Roots community members have asked about what a recession and commercial real estate crash would mean for Roots and their investment.

What is a Recession?

While definitions for a recession vary, the National Bureau of Economic Research defines it as, “a significant decline that lasts for more than a few months and affects the broader economy, not just a particular sector.” Simply put, a recession is an economic slowdown. When the overall economy, including businesses, jobs, and the buying and selling of goods and services, is not doing well, a recession happens.

Signs of a Pending Recession

There is no way to truly predict when – or even if – a recession will happen. Still, there are a few signs that can often point to the possibility of an oncoming recession, including job loss, decreased spending, struggling businesses, stock market decline, and housing market problems. On their own, these factors may not cause a recession, but when these signals work together, economists use the indicators to assess the current state of the economy and identify when a recession may occur. A recession will greatly impact the economy in all sectors, which includes real estate.

A Recession’s Effects on Real Estate in General

The biggest impact of an economic recession is that there is a decreased demand for real estate due to declined consumer and business spending. As a result, both residential and commercial real estate can feel the effects of the recession, as property values may fall.

Real estate, though we often speak of it broadly, breaks down into many different types across various sectors (commercial, residential, industrial, medical, etc.), and because of this, the impact of a recession is typically felt differently across these sectors and at different times. For example, with fewer people looking to purchase homes in a recession, residential real estate may take a hit as property values decline.

The most significant impact that an economic recession has is typically on the commercial real estate sector. This is because commercial real estate is more sensitive to the health of the economy. It is directly linked to business activity, and the demand for commercial office spaces is an excellent indicator for an expanding economy. According to Greg Reimers, a Banking Market manager for JP Morgan, “As consumer demand wanes, the industrial sector is likely to slow as inventories are managed down and the demand for industrial space decreases.” Essentially, he is saying that if there is a lack of demand for commercial business spaces, such as offices and retail centers, it is often a primary indicator of a suffering economy.

The Pending Commercial Real Estate Crash

The current scenario of a "lack of demand" for commercial business spaces is exactly what is happening now, creating major concern of a pending crash in commercial real estate that would in turn, likely become a full-on recession.

In November 23, Bloomberg released the results of a survey, in which analysts signaled their growing worry for America’s commercial real estate market. More than two-thirds of the 919 survey respondents predict a collapse in the office market within the next year.

Beginning in March 2020 with the COVID-19 pandemic, the condition of America’s commercial real estate has continued to worsen as more and more people begin to work from home, vacancy rates grow, prices fall, and interest rates hit their highest mark in twenty-two years.

Adding to the complications the commercial real estate market is already facing in the increasing lack of need for office buildings during the “work from home” era is the $1.5 trillion of commercial real estate debt that will be due by the end of 2025 which Morgan Stanley reported.

Regional banks are feeling this stress, too, as according to Goldman Sachs, regional lenders hold 30% of office building debt and continue to struggle with increasing interest rates. The combination of this debt, lack of demand for commercial real estate in the virtual work age, and interest rates continuing to grow, all point to a certain crash of the commercial real estate market.

The collapse of the commercial real estate market isn’t happening suddenly, though. The trends, property value, and growing interest rates have been happening for years, and while some analysts predict the market to bottom out in early 2024, some say that we won’t see the full effects until sometime in 2027.

Regardless of how quickly this happens, it’s clear that the commercial real estate market is destined for a correction, which will eventually make an impact on all aspects of the economy and may become a complete recession.

What Would a Recession and Commercial Real Estate Collapse Mean for Roots?

While the effects of a commercial real estate collapse and recession will be felt throughout much of the real estate market, including many REITs, Roots is in a unique position that defends well against market volatility and may even allow for growth in a time where many people are being forced to downsize.

The Roots Model and Strategy

It’s impossible to tell the future, and we can’t predict exactly how Roots will fare in the face of a recession, but there are a handful of reasons why Roots is more resilient in case of a downturn.

Purchase Timing

When compared to some contemporaries who were buying property during a time when the market was hot from 2019-2021, Roots is purchasing the majority of its properties now – during a cooler climate with higher interest rates, leading to Roots getting great deals via cash purchases.

Property Type

Roots consists of residential rentals, single family and small multi family, not commercial property.

Roots properties are workforce housing, and during tough times there are a lot of people who will need to move from their higher end apartments into more economical solutions like ours.

This class has shown to be resilient and holds a consistent value throughout all types of market conditions. According to data from ArborCrowd, single-family rentals have been “more resilient than other real estate classes in past downturns,”.

Location, Location, Location

Currently, Roots is comprised of homes found in the greater Atlanta market. Because of its growing population, strong economy, fortune company headquarters, and the film industry, Atlanta is one of the top real estate markets in the country.

The Live In Like You Own It® Program

Roots employs the revolutionary Live In Like You Own It® program. With Live In Like You Own It®, residents get to build wealth alongside the investors simply by paying rent on time, sending a quarterly walkthrough of the property, and being a good neighbor.

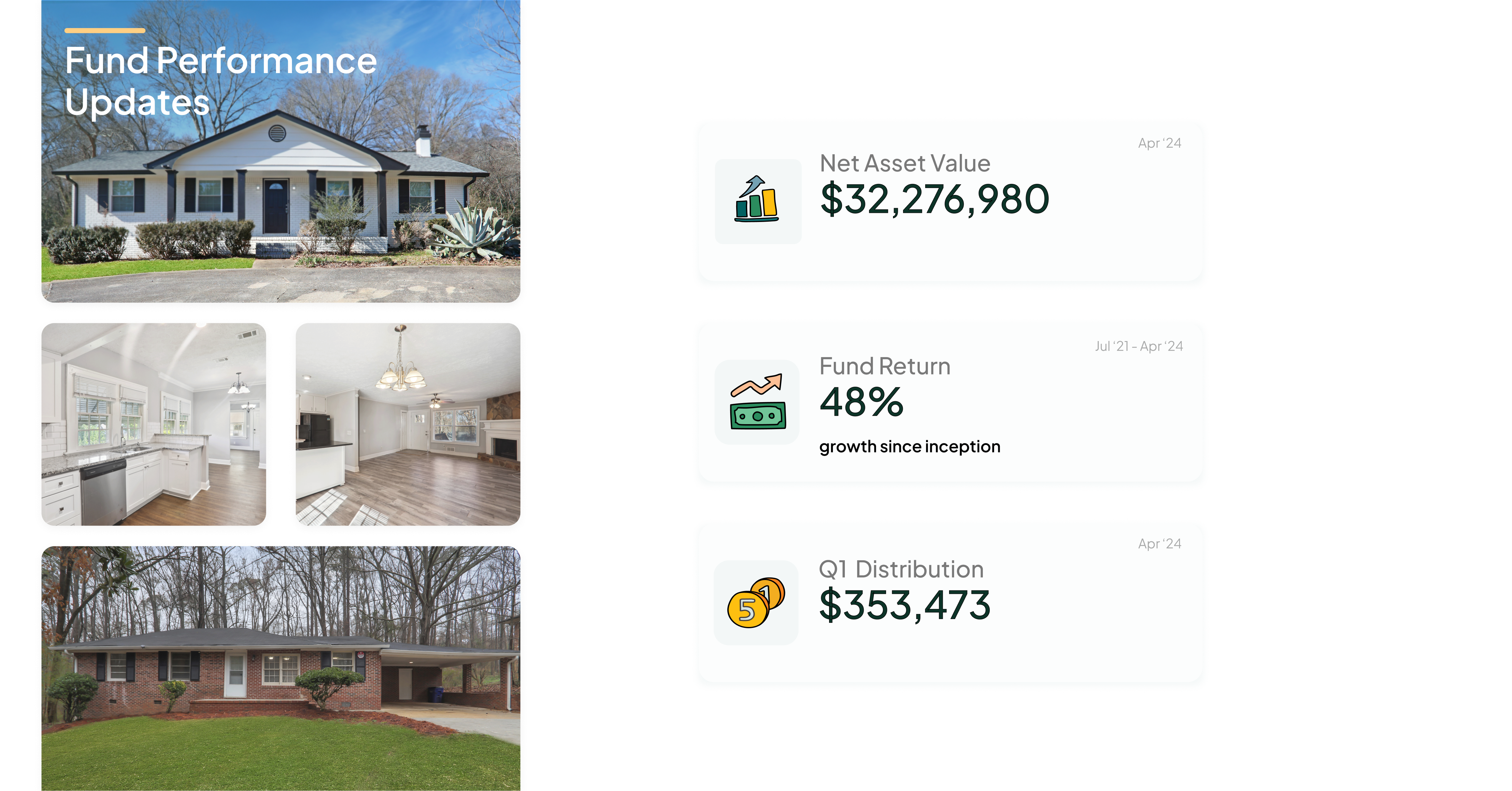

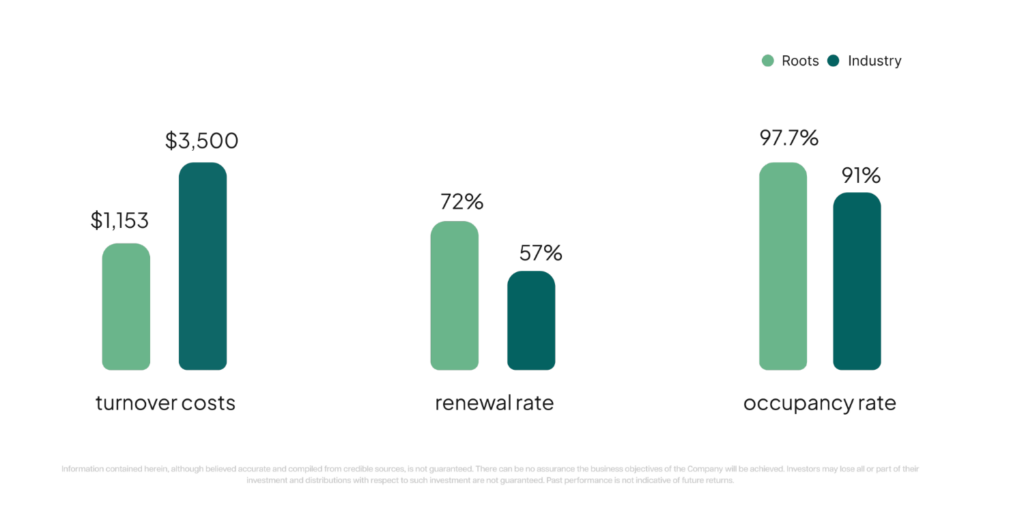

This program has led to fewer vacancies, lower turnover costs compared to other REITs, and perhaps most importantly, residents that choose to continue living in a Roots property… and who could blame them for not wanting to go back to paying a landlord without building wealth?

Debt

Roots has been very conservative with its debt, having less than 55% leverage on of its properties. It would take a massive shift for it to be underwater.

By being protected in property type, having engaged residents, with less debt on the books, Roots has generated immunity against a recession, regardless of the effects it may have on other real estate market sectors.

Ready To Get Started? Invest With Roots

Start InvestingImagine owning real estate where your renters wanted it to succeed as much as you do.

Start investing with as little as $100, and own a piece of the only REIT that creates wealth for both its investors and its residents. It took us years to build Roots, but you can invest in as little as 5 minutes.

Sources

- E152: Real estate chaos, WeWork bankruptcy, Biden regulates AI, Ukraine's “Cronkite Moment” & more

- Are We In A Recession Yet?

- 3 Signs that the Housing Market Will Crash in 2024

- What Happens During A Recession?

- What happens during a recession? Here is what is impacted in the economic downturn

- Forecast for US Recession Within Year Hits 100% in Blow to Biden

- Soft Landing, Here We Come?

- How Do Economists Determine Whether the Economy Is in a Recession?

- The Slow-Motion Crisis in Commercial Real Estate

- A $1.5 Trillion Crisis for Investors Is Brewing in This Hidden Corner of the Market

- How Multifamily Ourperformed Other Real Estate Sectors in Past Recessions

- Why Single-Family Rental (SFR) and Built-to-Rent (BTR) Communities are Resilient Assets

- What a Recession Could Mean for Commercial Real Estate