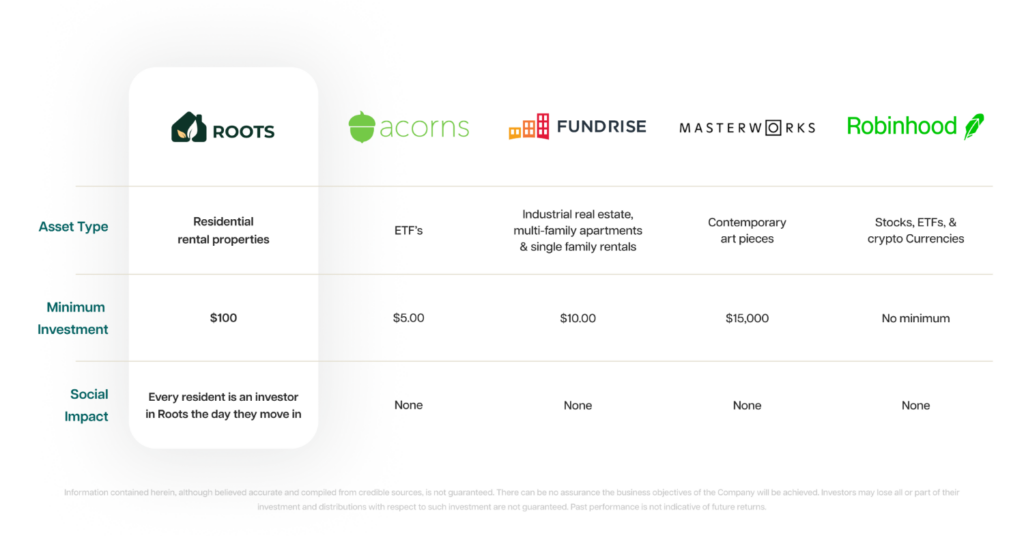

Top Alternative Investment Platforms in 2024: Acorns, Fundrise, Masterworks, Robinhood, and Roots

Years ago, "investing" was only associated with traditional stocks or bonds; that's no longer true. Today, you can invest in real estate, stocks, ETFs, cryptocurrency, venture capital, and even art! Not only that, it is easier now, more than ever, for anyone to start investing for as little as a few bucks. Nonetheless, it's imperative to research to determine the best investment opportunity for you.

Below are reviews for some of the top alternative investment platforms available in 2024, so continue reading to get your own alternate investment journey started!

Acorns

Overview

Acorns is an easy platform for anyone beginning their investment journey, as it offers users a way to invest passively. It acts as a robo-advisor that invests your spare change — and any other contributions you make — into a selection of about 25 low-cost, diversified ETFs (Exchange Traded Funds).

An ETF is an investment fund and exchange-traded product that combines features of mutual funds and individual stocks. ETFs are designed to track the performance of a specific index, commodity, bond, or basket of assets (like Blackrock's iShares Core S&P 500 ETF, which aims to replicate the performance of the S&P 500 index). With a debit or credit card linked to an Acorn account, investors can "Round-Up" their purchases to the nearest dollar and watch their money go safely into an accretive ETF or fund their accounts through recurring or on-demand deposits.

Minimum Investment

To invest with Acorns, you will need a minimum of $5 to start.

Fees

Acorns invests your savings into ETFs selected based on your financial goals and risk-comfortability, and they allow users to contribute as little as five dollars to their account with monthly flat fee rates between $3, $5, and $9, depending on your tier selection.

Investor Type

Anyone can invest with Acorns.

Advantages

Acorns is relatively inexpensive and very approachable. Round-Ups make it easy to put investing on autopilot. Because your contributions can be so small with this tool, it makes investing accessible for almost anyone- Acorns seems to be the perfect way for a high school or college student to put money away towards their retirement or student loans.

Roots

Overview

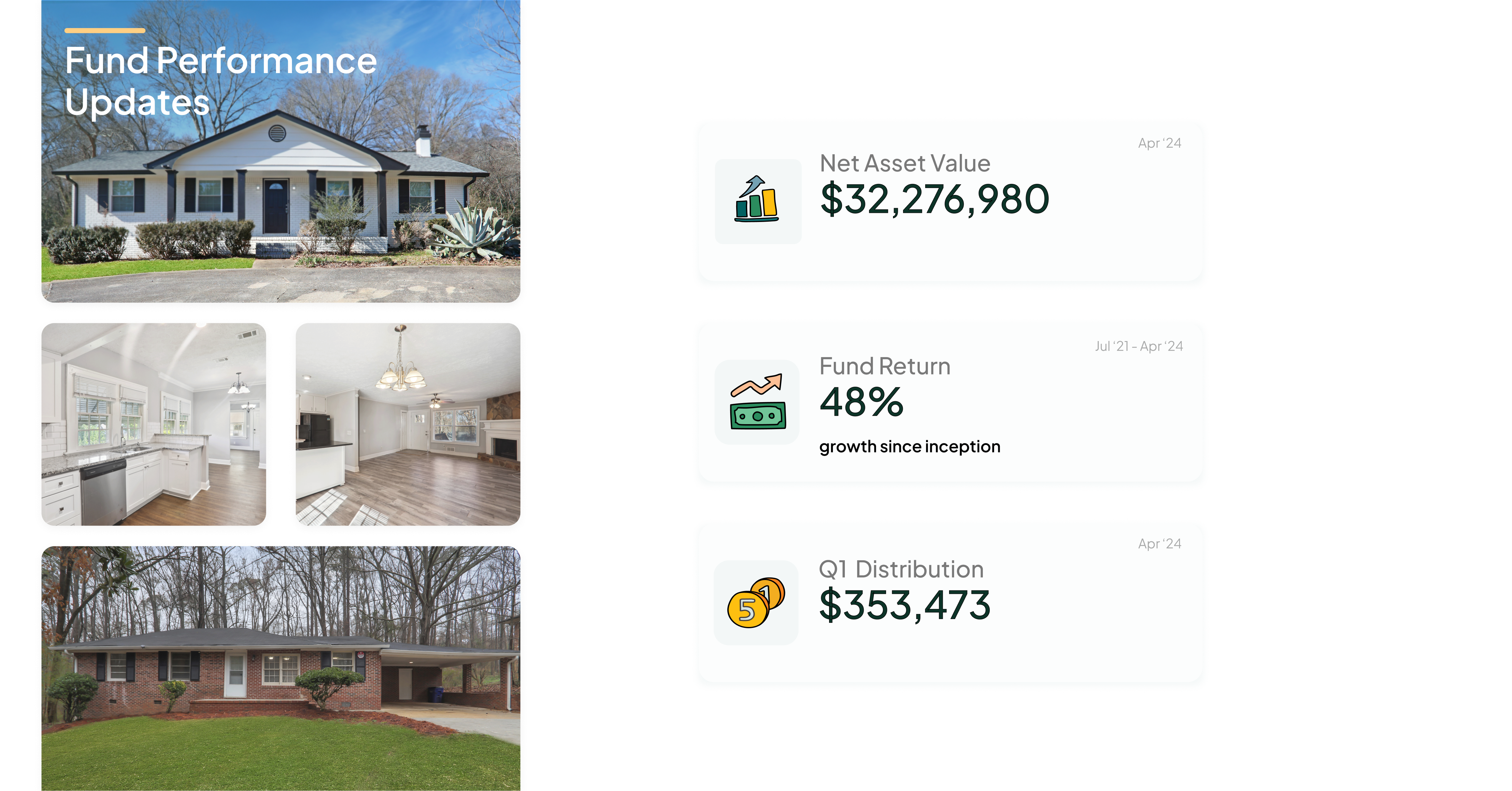

Roots, through its online REIT (real estate investment trust), offers a portfolio of residential rental properties in the greater Atlanta area. Roots has a unique model in which residents of Roots' properties get invested in the fund for being good renters. By simply paying rent on time, taking care of their property, and being a good neighbor, a Roots resident can gain tangible equity in the fund, something that's incredibly important to find in a country where 69% of Americans have less than $1,000 in savings. This program has led to less vacancy, lower turnover costs, and great returns for its investors.

Roots also distributes profits and allows investors to liquidate, quarterly.

Minimum Investment

Roots allows you to invest with a minimum of $100.

Fees

Roots has a low fee structure, with only a $5 transaction fee for your first investment and a $3 transaction fee on any recurring investment, which is a much lower and simpler fee structure than most private real estate investment opportunities. If you liquidate before one year with the fund, there is a 6% fee, but after the one-year mark, there is no fee to liquidate.

Type of Investor

Roots is open to all types of investors.

Advantages

Roots has returned 14.58% from April 1, 2023 - April 1, 2024, and 48% from July 1, 2021-April 1, 2024. Since the company's inception in July 2021, investors have garnered more than $1.4 million in distributions, with over $350,000 earned in the first quarter of 2024 alone. Yes, those are great returns that beat out other top-performing REITS (like most of Yieldstreet's), and sure, Roots is in a great spot because their portfolio consists of properties in the fourth-hottest real estate market in the country, but the fund's social impact may be its most compelling attribute.

Though its Live In It Like You Own It program®, Roots residents get invested in the fund simply by paying their rent on time and taking care of the property. Roots is on a mission to allow anyone to invest in real estate, even the residents who live in the properties.

Masterworks

Overview

Masterworks allows investors (accredited and non-accredited) to invest in fractional shares of fine, contemporary art pieces. Then, if said pieces are sold for profit, investors will see their investment returns. There is no promise of a return when investing on Masterworks, and since it's up to the investor to choose the piece, there is an inherent risk. In spite of that risk, Masterworks has completed over twenty successful sales to date after purchasing more than 300 pieces.

Masterworks charges a 1.5% annual management fee and 20% of any profits once a painting sells. Along with the substantial capital required to begin your investment and the subsequent fees investors pay after joining, investments can also take longer periods to pay off (due to the nature of art purchasing). Masterworks isn't desirable for the novice investor. That being said, they have generated an average realized net return of 17.8%.

Minimum Investment

To start investing with Masterworks, you’ll need $15,000 for the minimum first investment.

Fees

Masterworks charges a 1.5% annual management fee, plus the company takes 20% of any profits from an artwork’s sale. Other applicable fees may apply, which are detailed in the offering documentation that investors receive.

Type of Investor

Masterworks has the highest barriers to entry on this list. To invest with Masterworks, you need to be able to afford the costly minimum first investment and pass a quick interview process- not nearly as inclusive as investing with Acorns or Roots, but perfect for the experienced investor or art connoisseur.

Advantages

While Masterworks isn't accessible to middle-class, novice investors, it's a great concept. The contemporary art market has delivered an average annual return of 14.1% over the past 26 years- a better return than the S&P 500 during the same period. Masterworks has become the first platform to offer art investment products to the retail investing public. The company has sold almost two dozen paintings, all at a profit after fees. The artwork includes Cecily Brown (77.3% return, after fees), a George Condo (39.3%), and a Sam Gilliam (33.1%). For those who are high-earners and want to diversify their portfolio, Masterworks is a unique solution with consistently high returns.

Robinhood

Overview

Robinhood is a financial services platform that offers commission-free trading of stocks, options, exchange-traded funds (ETFs), and cryptocurrencies. Robinhood has an incredibly user-friendly platform made for everyday investors – specifically on mobile phones.

Robinhood appeals to the masses because their minimum investment is less than a penny, and they don't have high annual management fees, making it perfect for anyone who likes to trade frequently. Robinhood pays investors an interest rate of 1.5% on un-invested capital in their account – 5% if you elect to pay $5 per month for Robinhood Gold, their premium account tier, which is actually a higher yield compared to most similar brokers.

Minimum Investment

Robinhood has no minimum investment.

Fees

There's an adage that goes, "If you aren't paying for the product, you are the product," sadly, for Robinhood investors, critics feel like this saying rings true. Robinhood operates under the practice of pay for order flow (PFOF). PFOF is the practice of routing trades through market-makers (like Citadel Securities) in return for a slice of the profits. While this system has helped trading firms like Robinhood drive commissions to zero, it creates a conflict of interest. Critics say that Robinhood is incentivized to direct order flow to market makers offering PFOF arrangements over the interests of their clients. Robinhood's CEO has claimed that PFOF accounts for only five percent of the company's revenue, but many retail investors remain skeptical of the company, pessimism that largely stems from the time the app halted trading during the 2021 Gamestop short squeeze.

Type of Investor

Anyone can be an investor with Robinhood.

Advantages

The company is doing just fine for the number of people who don't trust Robinhood. It's consistently one of the top downloaded finance apps on the Apple store, and it's debatably the most accessible app to use for trading stocks because of its straightforward interface. Since there is no account minimum and it offers users a high interest rate on un-invested cash, it's a perfect app for learning how to buy and sell stocks.

Fundrise

Overview

If you're looking to broaden your real estate investments (or more recently get into Venture Capital investing) Fundrise might interest you. Fundrise offers investment opportunities across industrial real estate, multi-family apartments, and single-family rentals through an electric REIT (real estate investment trust), and recently launched a fund that specializes in venture capital investing.

Fundrise charges around 2% in total fees, and the company allows investors to withdraw at the beginning of each quarter – though liquidation before five years in the fund will result in a 1% penalty of your total share value. Historically, Fundrise only has an average annual return of 4.81% (real estate), so it may not be a good fit if you are looking for above average returns. As of this writing, Its too early to understand what the venture capital fund will yield.

Minimum Investment

The minimum investment for Fundrise is just $10.

Fees

Fundrise charges a 0.15% advisory fee and an annual 0.85% flat management fee. The Fundrise Innovation Fund, their fund for Venture Capital investing, has an annual 1.85% flat management fee.

Type of Investor

Fundrise is open to all investors.

Advantages

Fundrise offers a minimum investment that's less than Roots and they also have more property types, including industrial properties, commercial real estate, and most recently launched a fund specializing in venture capital investing. Fundrise also has a fair amount of credibility, as it was one of the first online real estate investing vehicles for non accredited investors.

Ready To Get Started? Invest With Roots

Start InvestingImagine owning real estate where your renters wanted it to succeed as much as you do.

Start investing with as little as $100, and own a piece of the only REIT that creates wealth for both its investors and its residents. It took us years to build Roots, but you can invest in as little as 5 minutes.

Sources

- Roots - Social Impact

- Roots - Performance

- Fundrise - Everything You’ve Ever Wanted to know about Fundrise’s Fees

- Fundrise - Real-time average’s on client returns

- How Much Money Do You Need to Start Investing

- Masterworks FAQ

- Masterworks Review 2024

- Ways to invest with Masterworks

- What’s Robinhood Gold?