Comparing Top Performing REITS: Roots vs BlackStone’s BREIT vs YieldStreet

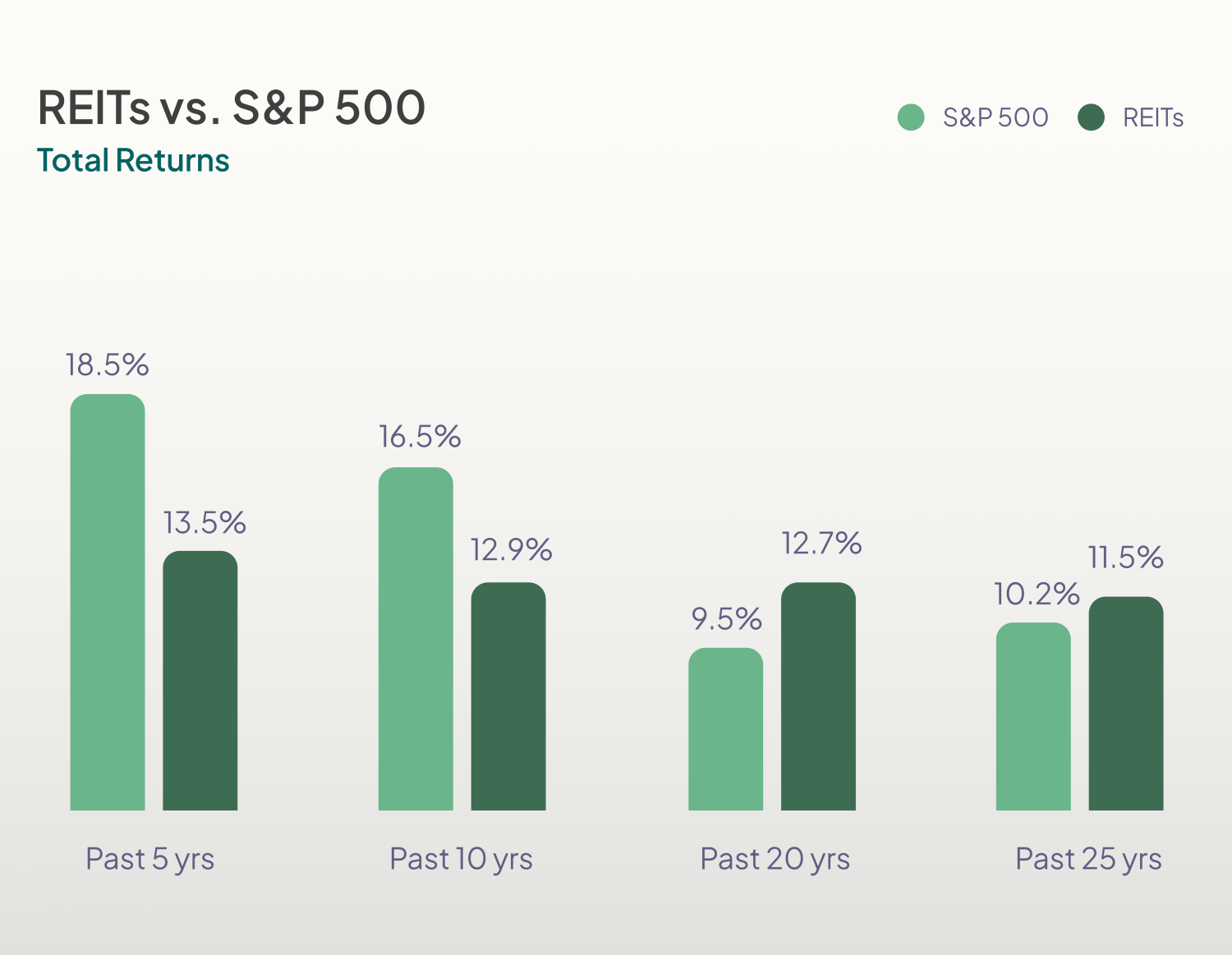

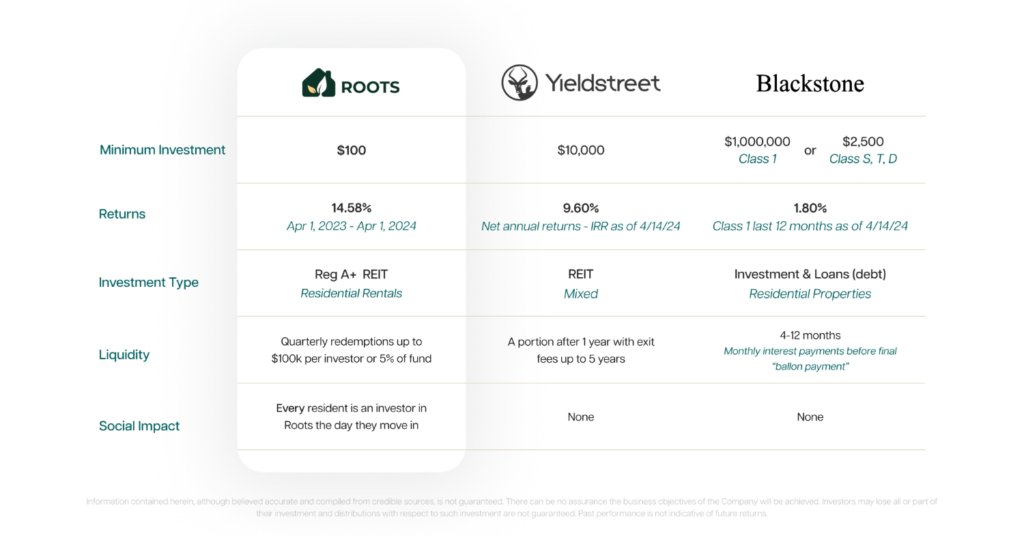

Investing in real estate can be a great option to diversify your portfolio, but getting started can be difficult. Companies like Roots, Blackstone (BREIT) and YieldStreet make real estate investing accessible and easier to manage via their online REIT investing platforms and products. All platforms offer different minimum investment options and strategies that they use to grow their funds. The decision ultimately comes down to your individual goals and preferences.

If you are looking for less fees, lower minimums, and to invest in real estate that has a unique, positive social impact on the renters, Roots is for you.

If you’re an experienced investor, have the time to coordinate with a financial advisor, and want to allocate a larger amount of resources to bet on a REIT, BlackStone’s BREIT may be the right one for you.

If you’re content with a higher minimum investment and enjoy very diversified portfolios, YieldStreet might be better for you.

Below you'll find an in-depth review of Roots, BlackStone's BREIT, and YieldStreet, highlighting their differences across 5 dimensions: property type, minimums, fees, liquidity and average returns.

Property Type

Roots, YieldStreet, and BlackStone's BREIT each offer a unique portfolio of real estate assets.

BlackStone (BREIT)

Blackstone offers a non-listed REIT called the “BREIT”. The BREIT offers a fund based on commercial real estate and real estate debt investments which allows them to give collateralized loans to real estate investors. This REIT can be purchased through BlackStone’s financial advisory team and are not offered online directly to investors.

YieldStreet

Yieldstreet offers multiple property types: multi-family, industrial, office, single family rentals, storage, and more. YieldStreet also announced that “The Fund also seeks to invest across different investment types including, but not limited to, first lien mortgage loans and preferred equity opportunities to help generate current and regular income for investors.”

Roots

Roots offers one investment option, a portfolio of residential rental properties made up of single family and small multi family. Roots has a unique model where the residents of the properties get invested in the fund if they are good renters (pay rent on time, take care of the property, and are a good neighbor). This has led to less vacancy, lower turn costs, and higher returns for its investors, as you’ll see below.

Minimum Investments, Fees & Liquidity

Roots, BlackStone, and YieldStreet make real estate investing easy, but when it comes to fees and liquidity, each company differs significantly.

Roots

Roots allows you to invest with a $100 minimum. Unlike Fundrise and RealtyMogul, Roots has a lower fee structure, with only a $5 transaction fee for your first investment and a $3 transaction fee on any recurring investment. If you need to liquidate your investment before one year, there is a 6% early withdrawal fee, but other than that there are no fees to investors.

Roots distributes to investors quarterly, providing investors the option to reinvest or cash out their distributions at that point in time. Roots offer the ability to liquidate quarterly as well, $100k or up to 5% of the fund.

BlackStone (BREIT)

BlackStone allows you to invest with a $2,500 minimum for their Class D, S, and T shares and a $1,000,000 minimum investment for their Class I shares. Unlike the other REITs mentioned in this article, BlackStone is open to investors based on a minimum income requirement of $70,000 annually, or a net worth of at least $250,000.

BlackStone offers monthly distributions for the BREIT but cautions investors that these are not guaranteed. They have a limited amount of repurchases that they choose to make in each month or quarter, and can potentially choose to repurchase none of the submitted shares.

BlackStone has a 1.25% management fee per annum NAV, payable monthly along with fees for performance participation allocation. To learn more, please see the link “BlackStone - BREIT Offering Terms” below for more information.

YieldStreet

YieldStreet allows you to invest with a $10,000 minimum. They have utilized a concept they call “DRIP” which automatically invests an investor's distributions back into their fund. Investors have the option to opt out of this feature but should be aware that it's on by default.

YieldStreet has a 1.5% annual asset management fee, and a 0.5% fee for operating expenses that is deducted from distributable cash.

YieldStreet’s policy indicates that investors may not touch any of their funds for the first year. After that, investors have the option to potentially liquidate a portion of their investments on a quarterly basis. Investors should be cautious of early withdrawal fees that will occur if the funds are removed within the first five years of their initial investment request date. To learn more, please see the link “YieldStreet - Essentials” below for more information.

Performance

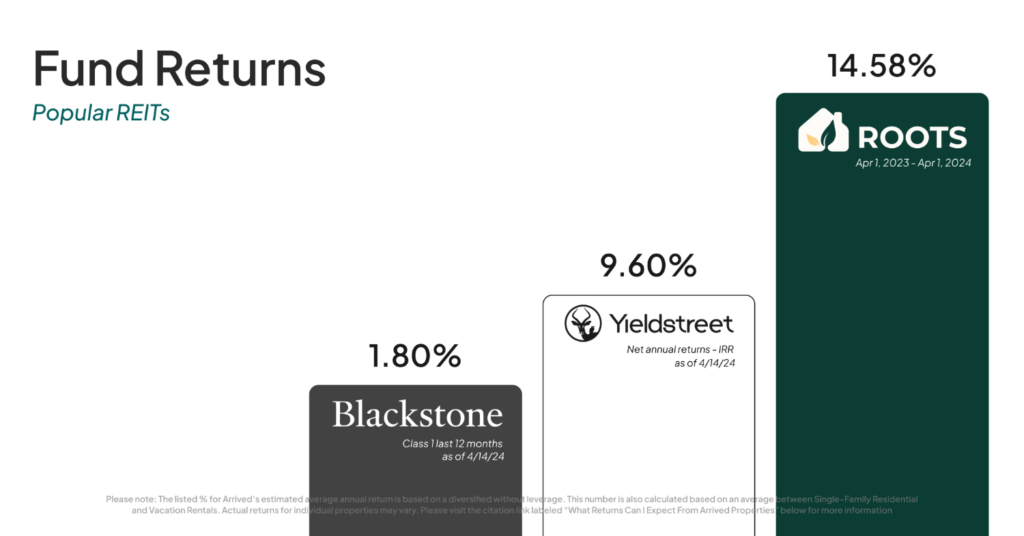

All platforms have delivered returns to their investors with Roots leading the way.

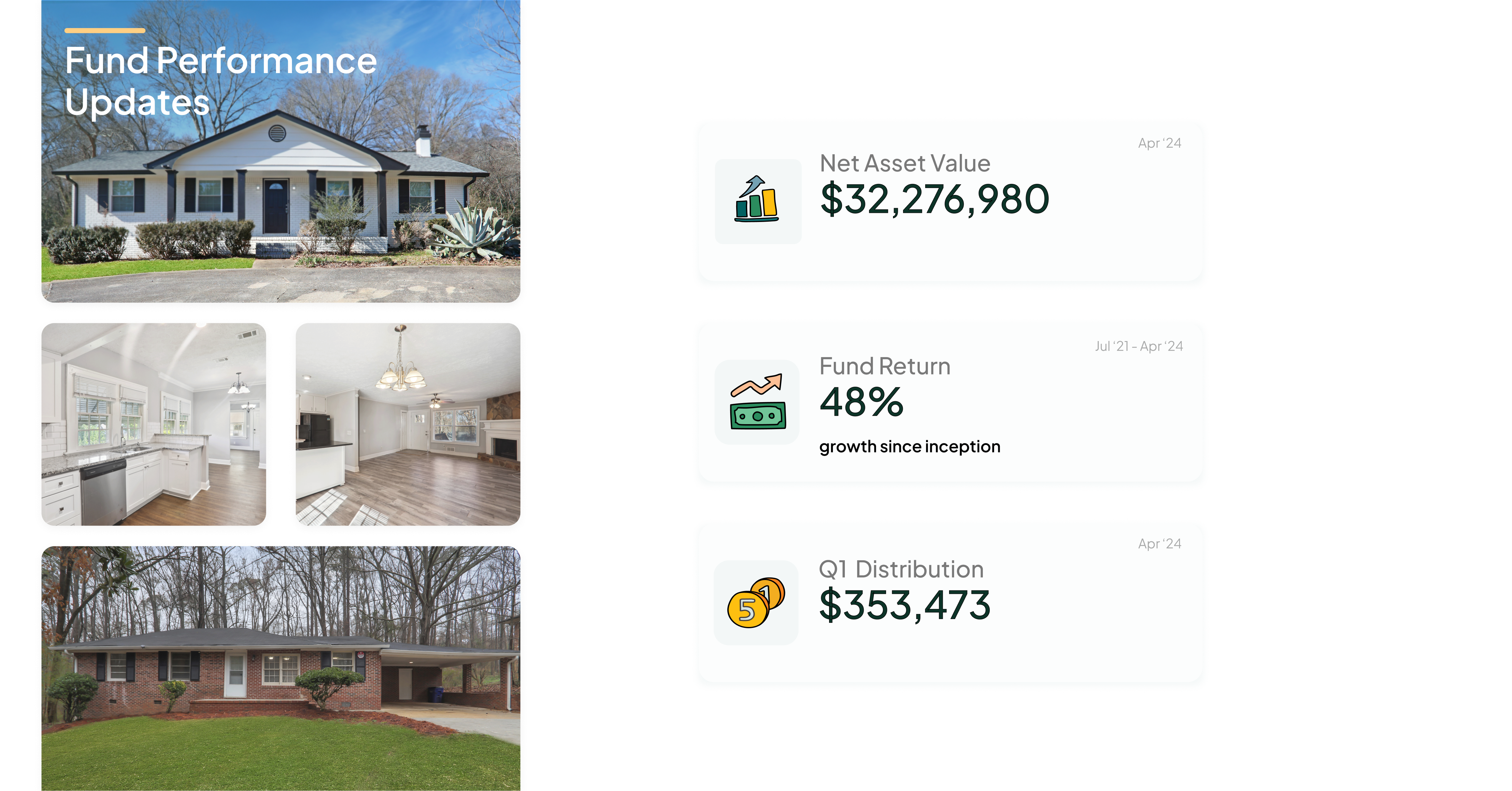

Roots is up 14.58% from April 1, 2023 - April 1, 2024 and 48% from July 1, 2021 - April 1, 2024.

BlackStone (BREIT) reported a 1.8% return on its BREIT “Class I” from the last 12 months, and a 4.7% annualized distribution rate. Since its inception, BlackStone has had an annualized return of 10.5% on their “Class I” shares.

YieldStreet has a net annualized return of 9.6%.

However, it's crucial to note that past performance is not a guarantee of future results. There are always risks in investing, and it's essential to understand them before investing your money.

Ready To Get Started? Invest With Roots

Start InvestingImagine owning real estate where your renters wanted it to succeed as much as you do.

Start investing with as little as $100, and own a piece of the only REIT that creates wealth for both its investors and its residents. It took us years to build Roots, but you can invest in as little as 5 minutes.

Sources