3 Popular Real Estate Investment Options for 2024 – Compare Roots vs. Roofstock vs. Crowdstreet

When looking to diversify your investment portfolio, real estate is one of the best options available, but it isn’t always easy to get started. Finding the right place to invest can be a challenge, but Roofstock, Crowdstreet, and Roots make real estate investment easy with transparent online platforms that are easy to use and easy to understand.

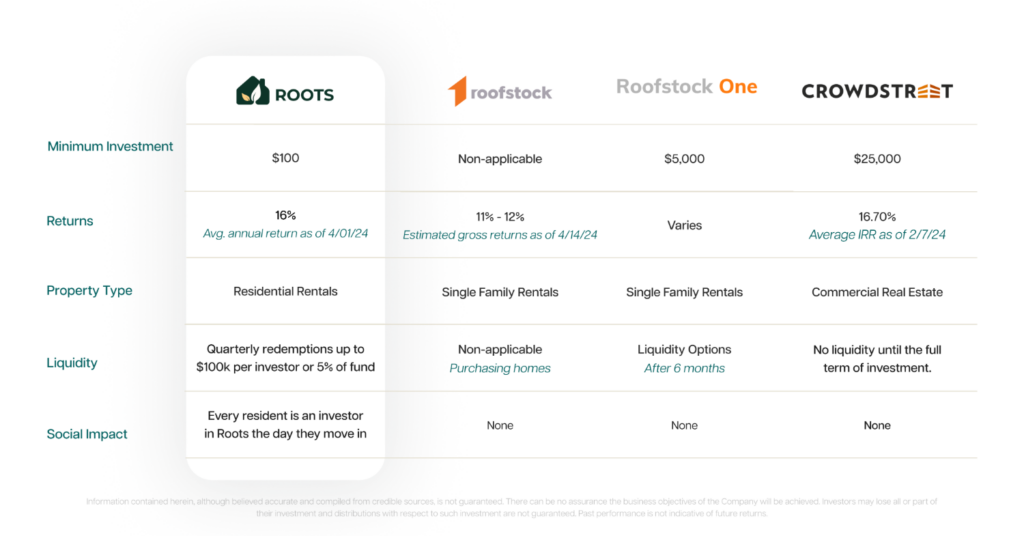

If you are looking for less fees, lower minimums and a portfolio that has a one-of-a-kind social impact on its renters, Roots is for you.

If you are very interested in commercial real estate and are okay with a higher minimum, then Crowdstreet may be right for you.

If you’re looking to purchase or sell a single family rental property instead of investing in a portfolio of properties, then Roofstock may be the best option for you.

Roofstock, Crowdstreet, and Roots all offer great ways to invest in real estate without hurdles like property management or rent collection. Below we'll compare them across 5 key dimensions: property type, minimums, fees, liquidity and average returns.

Property Type

Roofstock

Roofstock's marketplace of single family rentals, or Roofstock One, its portfolio product, both focus on single family rental asset class.

Crowdstreet

Crowdstreet offers a diverse pool of commercial real estate options to choose from when investing.

Roots

Roots offers investors a portfolio of residential rental properties in which its residents become invested in the fund alongside the investors, which has led to lower vacancy, lower turn costs, and higher returns for its investors as you’ll see below.

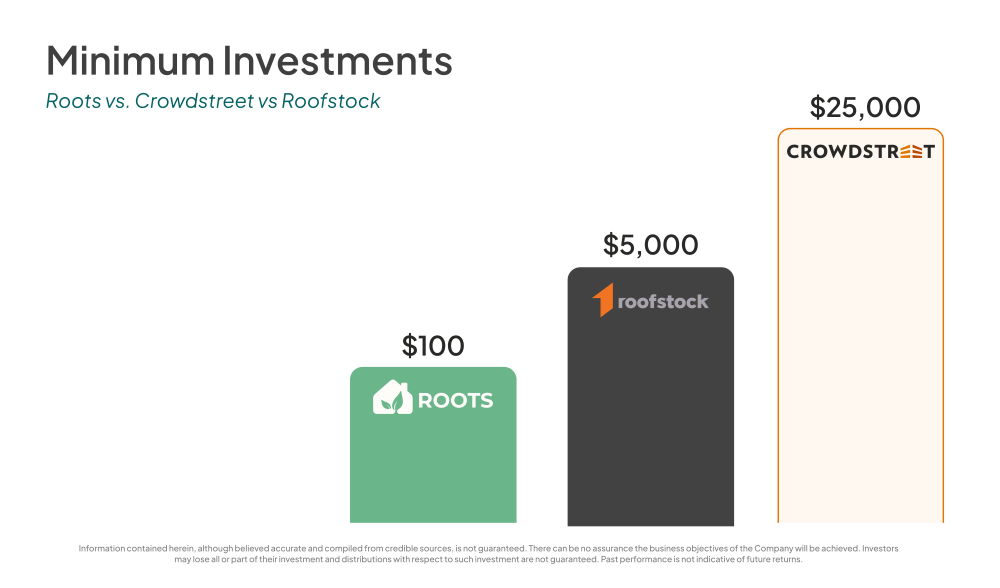

Minimum Investments, Fees, and Liquidity

Roofstock

Roofstock products are open to accredited investors only. Roofstock One does not charge any fees, while Roofstock does. Depending on which is higher, it charges $500 or .5% of the contract price for any offers on their properties and 3% or $2,500 of the sale price to anyone selling a property.

There is no minimum investment for Roofstock as you are buying or selling a property on its marketplace, but Roofstock One requires a minimum investment of $5,000, with investment options as low as $100 after the initial investment.

Liquidity is non-applicable to Roofstock, as its function is to allow purchasing and selling of homes on their marketplace, but Roofstock One offers its investors multiple liquidity options once the initial six-month holding period ends.

Roots

Roots allows you to invest with a $100 minimum.

Unlike Fundrise and Crowdstreet, Roots has a lower fee structure, with only a $5 transaction fee for your first investment and a $3 transaction fee on any recurring investment.

If you need to liquidate your funds before one year, there is a 6% early withdrawal fee, but other than that there are no fees to investors.

Roots distributes to investors quarterly, providing investors the option to reinvest or cash out their distributions at that point in time.

Roots offers the ability to liquidate quarterly as well, $100k or up to 5% of the fund.

Crowdstreet

Crowdstreet offers different options to any accredited investor. You can choose to invest in a diversified fund through Crowdstreet directly, leaving the management up to Crowdstreet’s real estate professionals or through single sponsor funds from specific real estate firms.

Crowdstreet also offers individual deals, which allow investors to communicate directly with sponsors, which removes Crowdstreet as a middle man, and they also offer tailored portfolios, which connects the investor with a Crowdstreet advisor. The advisor then assists the investor in developing a personalized commercial real estate portfolio.

Fees vary depending on the investment, going as high as 2.5% for a Tailored Portfolio.

Crowdstreet’s investment horizon is long-term, meaning it is very illiquid and investors are in it for the long haul.

Crowdstreet requires $25,000 as a minimum initial investment, but depending on the type of investment made, the minimum may be higher – as high as $250,000 if you choose the Tailored Portfolio option.

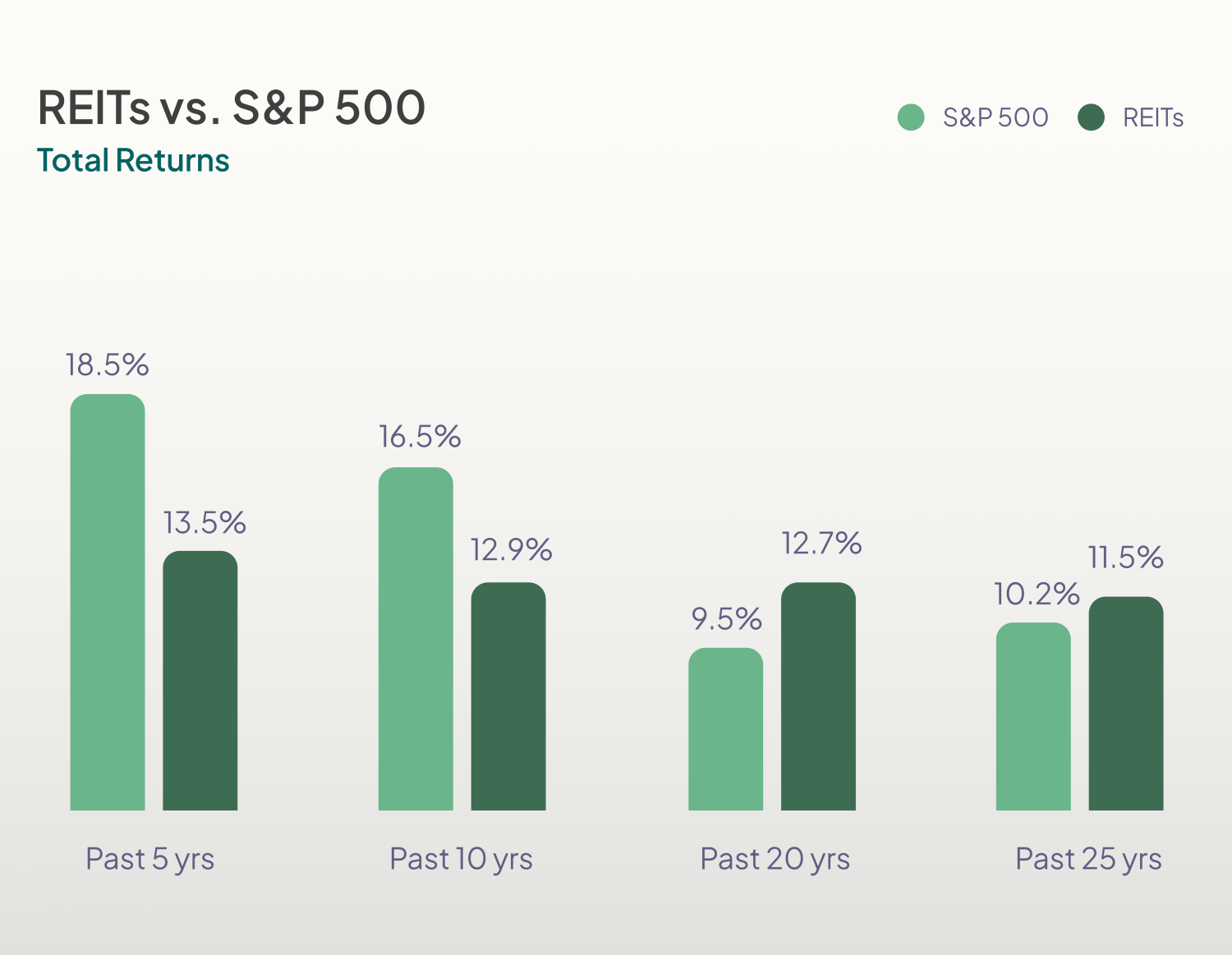

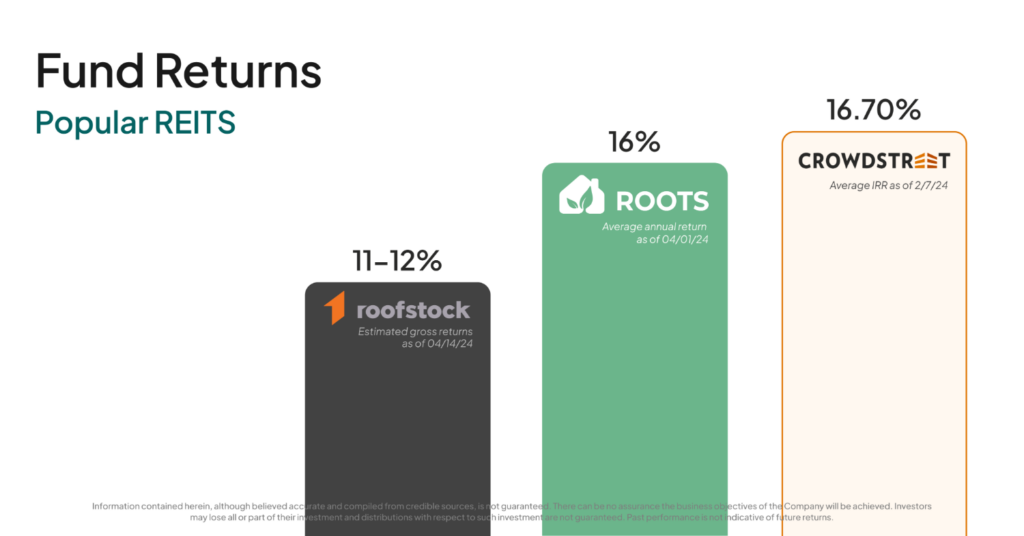

Returns

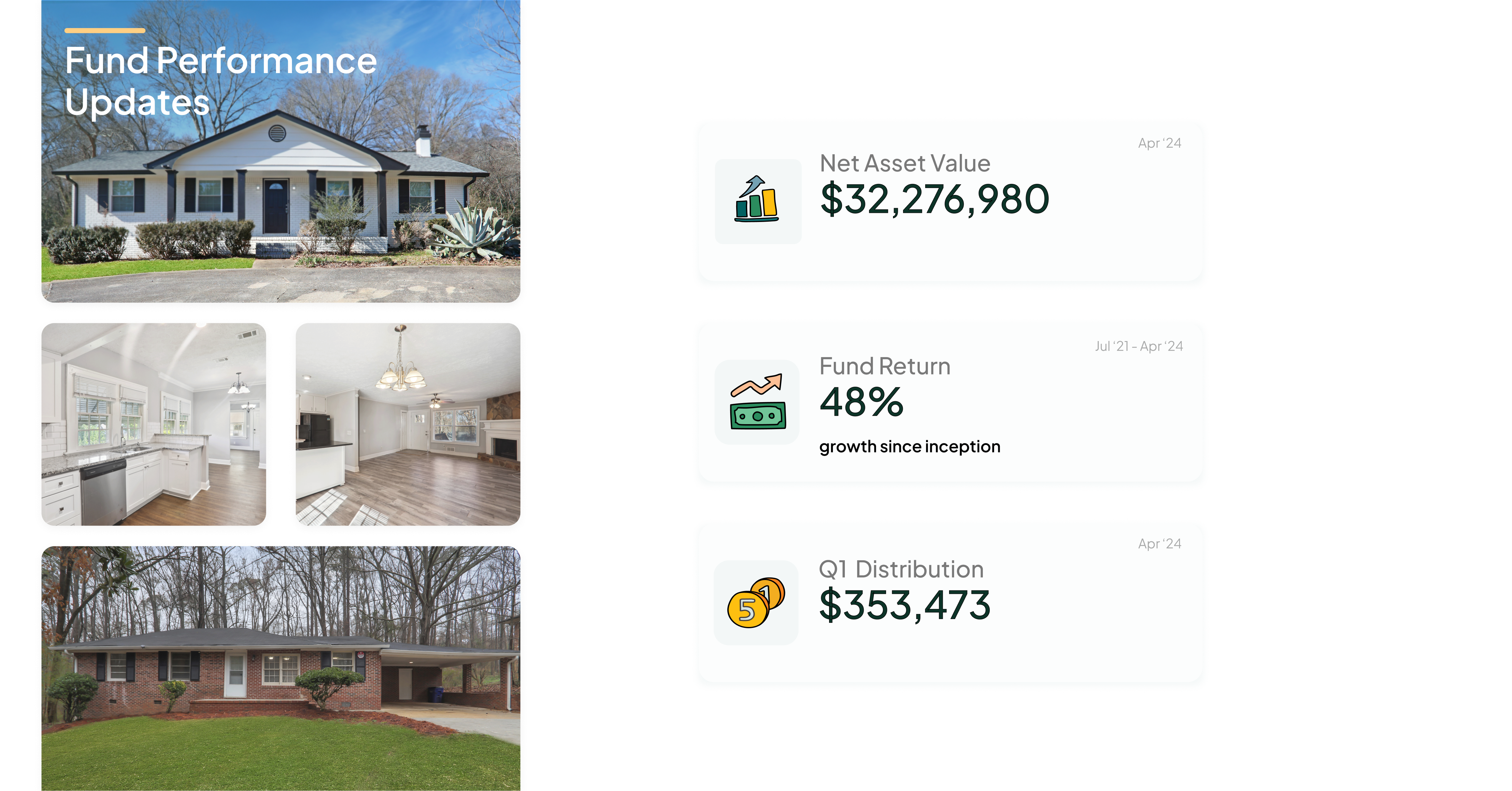

The Roots Fund had an average annual return of 16% as of April 1, 2024 and has returned 48% from July 1, 2021- April 1, 2024.

Crowdstreet reports an annualized historic internal rate of return of 16.7%.

Most properties on Roofstock are projected to have a cap rate of 5-8% and a gross return of 11-12%, net of expenses. According to Business Insider, the average annual return is between 6-20%. Since you’re buying individual properties, the range is large. Returns from Roofstock One vary with the type of investment made.

Even though historically all three companies have delivered returns to investors, it’s important to remember that past results do not determine future success. Risks are always present when investing your money, so it’s important to understand what those risks are before making your first investment.

Ready To Get Started? Invest With Roots

Start InvestingImagine owning real estate where your renters wanted it to succeed as much as you do.

Start investing with as little as $100, and own a piece of the only REIT that creates wealth for both its investors and its residents. It took us years to build Roots, but you can invest in as little as 5 minutes.

Sources