Invest in a Public or Private REIT? – Highlighting REIT flavors by comparing VNQ, BREIT and Roots

Real estate investment trusts (REITs) are a popular choice for investors looking to add real estate value to their portfolios without the hassle of owning, managing, and renting their own physical properties. REITs pool money from investors to buy and manage real estate and return a portion of the profits to those shareholders in the form of dividends or appreciation, much like owning a stock.

Key Differences between a public REIT and a private REIT, like Roots

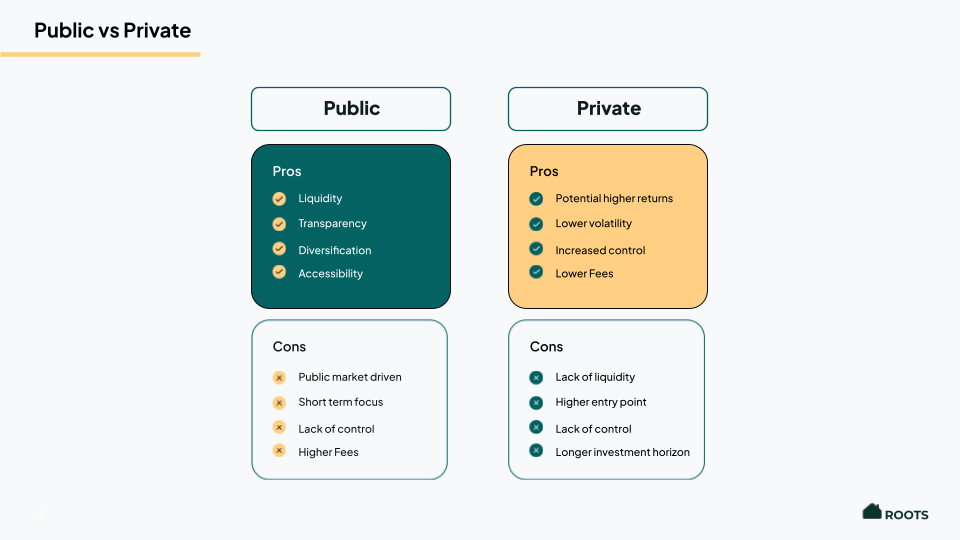

Public REITs are listed on stock exchanges, which means they are beholden to public sentiment to drive up or down the price. Said another way, Public REITs aren’t necessarily buying real estate, they’re buying the stock market. However, with a public REIT you get a lot of transparency and oversight from the SEC, and like a stock, they are easy to liquidate.

On the flip side, private REITs are a limited partnership business, usually making liquidation more difficult, but are generally less volatile because they aren’t affected by public perception and more so by the actual real estate held in the REIT and the fund's management team. Private REIT reporting can also be less transparent, but can have higher returns because of less administrative and legal overhead and lower fees.

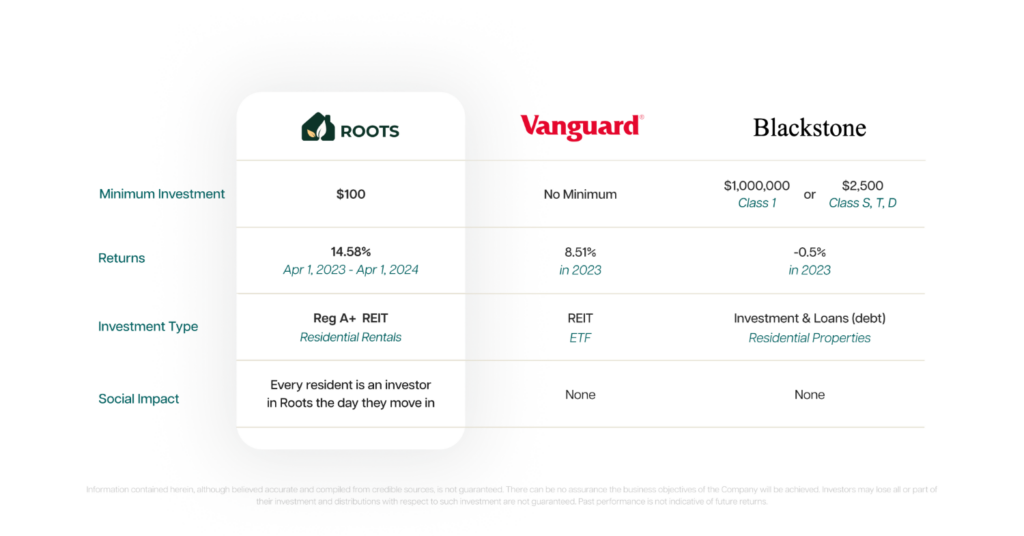

If this sounds complicated, don't worry…. it's not. We will illustrate the differences between different REIT offerings by comparing the flavors of Roots, a private REIT focused on residential, to the REIT products offered by Vanguard, a public option, and Blackstone, a large non-listed option focused on commercial.

Breaking Down Roots, BREIT, and VNQ on Property Type and Reporting

Roots

Roots is a private REIT portfolio of 114 single and small multi-family residential rental properties, currently in the greater Atlanta area. Roots has a unique model in which residents of Roots' properties get invested in the fund for being good renters. By simply paying rent on time, taking care of their property, and being a respectful neighbor, a Roots resident can gain tangible equity in the fund, something that's incredibly rare to find in a country where 69% of Americans have less than $1,000 in savings.

This model has led to less vacancy, lower turnover costs, and higher returns for its investors, all while giving people from all walks of life the opportunity to grow wealth while renting.

And interestingly like its public counterparts, Roots is subject to financial reporting within SEC guidelines through its REG A+ designation.

Blackstone's BREIT

Blackstone is the 1000-pound gorilla in any real estate room, and in this case has a very large “private” non-listed REIT appropriately named BREIT.

BREIT allows individual investors to invest in institutional-grade commercial properties, typically only available to large institutions. BREIT's portfolio is concentrated in high-growth sectors, including data centers, warehouses, student housing, and the fast-growing Sunbelt market.

BREIT is the largest owner of student housing in the United States and also owns QTS, one of the fastest-growing data center companies. BREIT also invests in multi-family, single-family, and affordable housing.

Vanguard VNQ

Vanguard's REIT product, or VNQ, is an ETF that invests in stocks issued by REIT companies that purchase office buildings, hotels, data centers, warehouses, multi-family housing, single-family housing, storage, telecom, and more. This is great for investors who want to diversify their REIT risk.

Right now, the commercial office space market is collapsing. Businesses occupy 200 million square feet less than they did before COVID, with another 150 million square feet of this so-called negative absorption expected to be added over the next two years. That said, the commercial real estate market for data centers is strong, and VNQ has almost double the amount of data center REITs in its portfolio compared to that of office centers.

Because VNQ is publicly listed, the fund is largely dictated by public sentiment. When the public gets scared and sheds their shares during times of economic crisis, the price of VNQ responds to the distress.

Returns and Red Flags

Roots

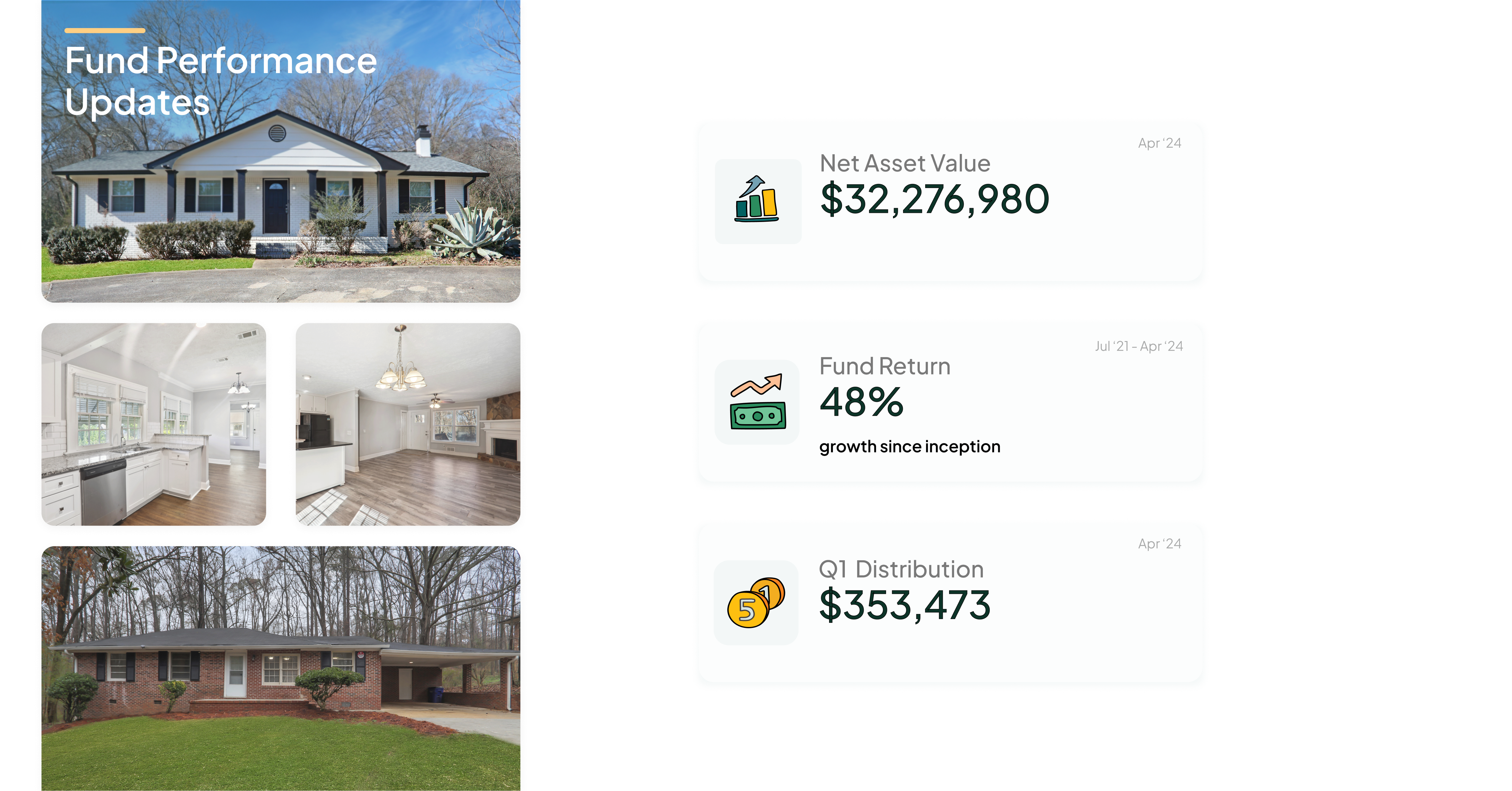

Since its inception in July 2021, Roots has returned a whopping 48%, has a historical average annual return of 16%, and distributed $353,473.85 in dividends to investors last quarter.

Roots has been able to buy properties on the low side, fix them up, rent them out, and then add them to the fund, all in Atlanta, which is also rated the 4th best real estate investment market for 2024 by PwC and the 6th best by Zillow. The company’s strategy to acquire residential properties and its Live in It Like You Own It™ program, creating partners, not tenants, along with Atlanta’s hot market, have culminated into high returns and happy investors.

Roots' biggest red flag is that the company lacks diversification. As of now, it focuses only on residential and only in greater Atlanta.

Blackstone's BREIT

Blackstone reports an annualized net return of 10.5% since BREIT's inception in 2017, which is higher than the average publicly traded REIT during this timeframe. While it has been historically dependable, BREIT had a rough 2023, and 2024 does not look much better. BREIT returned a measly -0.5% last year, and year to date, they've returned just 1.0%, a far cry from their performance in years past.

Why? The rapid rise in interest rates spooked investors at all REITs, but Blackstone's response was especially problematic. The fund restricted redemptions from November 2022 until February of this year, when withdrawal requests were fully paid out.

And recently, Bloomberg reported that BREIT paid out more to investors than it generated last year. The fund generated $2.7bn in cash flows in 2023 but distributed more than $2.8bn to investors. Operating at a deficit is a MAJOR red flag for a REIT. REITs have to pay out 90 percent of profit, but anything over 100 percent is seen as unsustainable because funds might eventually need to take on more debt, issue new shares, or sell assets to fund dividends.

Vanguard (VNQ)

VNQ seeks to provide high-income and moderate long-term capital appreciation by tracking the MSCI US Investable Market Real Estate 25/50 Index. This index measures the performance of publicly traded equity REITs and other real estate-related investments in the United States. Over the last three years, VNQ has returned a mediocre 5.21%, but it did have an impressive 2023, netting customers an 8.51% return. This year, VNQ has started the year cold, returning just -4.08% to customers since the beginning of 2024.

VNQ is made up of a vast portfolio, which makes it relatively safe from going completely down, but its with a 5.21% yield over the last three years and a negative return year to date, you can see the affect of public perception on commercial focused funds.

Comparison of Minimum Investment, Fees, and Liquidity

Roots

Roots requires only a $100 minimum investment and is open to both non accredited and accredited investors. It charges a modest one-time $5 transaction fee for your first investment, and this gets reduced to a one-time $3 transaction fee on any recurring investment.

Roots distributes to investors quarterly, and investors have the option to reinvest or cash out their distributions at that point in time.

There is a 6% early withdrawal fee (less than 12 months after any given investment), but there is no fee to liquidate after 12 months of any given investment.

Overall, Roots’ fees are lower for most investors who keep their money in for a longtime. Unlike most investment products, there is no annoying management fee that adds up.

Blackstone BREIT

Blackstone allows you to invest with a $2,500 minimum for their Class D, S, and T shares and a $1,000,000 minimum investment for their Class I shares. Unlike the other REITs mentioned in this article, Blackstone is open to investors based on a minimum income requirement of $70,000 annually or a net worth of at least $250,000.

Blackstone offers monthly distributions for the BREIT but cautions investors that these are not guaranteed. They have a limited number of repurchases that they choose to make each month or quarter and can potentially choose to repurchase none of the submitted shares.

Blackstone has a 1.25% management fee, a stockholder servicing fee, a selling commission fee, and a high-performance fee.

Vanguard (VNQ)

Since VNQ is a publicly traded ETF, there is no minimum investment. However, each investment has a 0.12% annual management fee, which is a decent rate. The ETF also offers quarterly distributions to investors.

Ready To Get Started? Invest With Roots

Start InvestingImagine owning real estate where your renters wanted it to succeed as much as you do.

Start investing with as little as $100, and you can join the thousands across America that are investing with Roots, the only REIT that grows wealth for both its investors and its residents. With Roots’ “win-win” model, you can increase passive income, save for retirement, and grow your wealth. All while helping the residents grow theirs.

Sources