Plausible Paths to Passive Income – Best Apps to Save (and Grow) Your Money in 2024

Years of inflation and high interest rates have decimated the average American's ability to save money. According to a new Bankrate survey, more than one-third (36%) of US adults have more credit card debt than emergency savings.

Luckily, there's a solution. Over the past decade, various financial service platforms with low barriers to entry have become available for everyday people looking to passively save and grow their money without having to dive deeply into stock market research or financial analytics.

Below are reviews of the best passive internet-based financial savings and investment platforms for 2024: what they offer, their fees, and how their services work. While it's critical that you do your own research, this synopsis should assist you in finding the best financial platform for your needs and interests; let's get started!

Overview:

Chime is an easy-to-use online banking platform that offers basic deposit accounts and other fantastic services such as automated savings tools, credit-building solutions, early direct deposit, overdraft protection, a welcome bonus, and more.

Similarly to Acorns, Chime is famous for its "Save When You Spend" program. This initiative helps customers save by automatically rounding up transactions to the nearest dollar and transferring the extra funds into an automatic savings account.

Chime also makes it seamless to automatically deposit money from every paycheck into said savings account, bringing their customers closer to their future financial goals.

A Chime savings account's APY (annual percentage yield) is high-interest for a bank, coming in at a red-hot 2%. To put that in perspective, Bank of America's is 0.01%.

Minimum Investment

Chime has no minimum requirement to start. Prospective users can start with as little as $0.

Fees

Unlike traditional brick-and-mortar banks, Chime hardly charges fees. They have no minimum balance fee, maintenance fee, monthly fee, direct deposit fee, or overdraft fee, and surprisingly enough, there isn't even a card replacement fee (unless a user chooses to expedite their new card). With Chime, there's one fee: the bank assesses a $2.50 fee for ATM withdrawal at out-of-network locations (which is rarely an issue as Chime has over 60,000 fee-free ATMs).

Investor Type

Anyone can bank with Chime.

Advantages

On paper, Chime is the perfect app for someone just developing financial literacy. With tens of thousands of fee-free ATMs, a high savings account APY, and credit-building tools, Chime is the right bank for people just beginning to make money or those starting all over again.

Disadvantages

Chime's 2% APY beats out the well-established legacy banks, but it falls a little flat compared to other online banks. More importantly, past customers tells us that Chime has serious security issues. Why trust a bank if you can't ensure your money is safe?

Overview

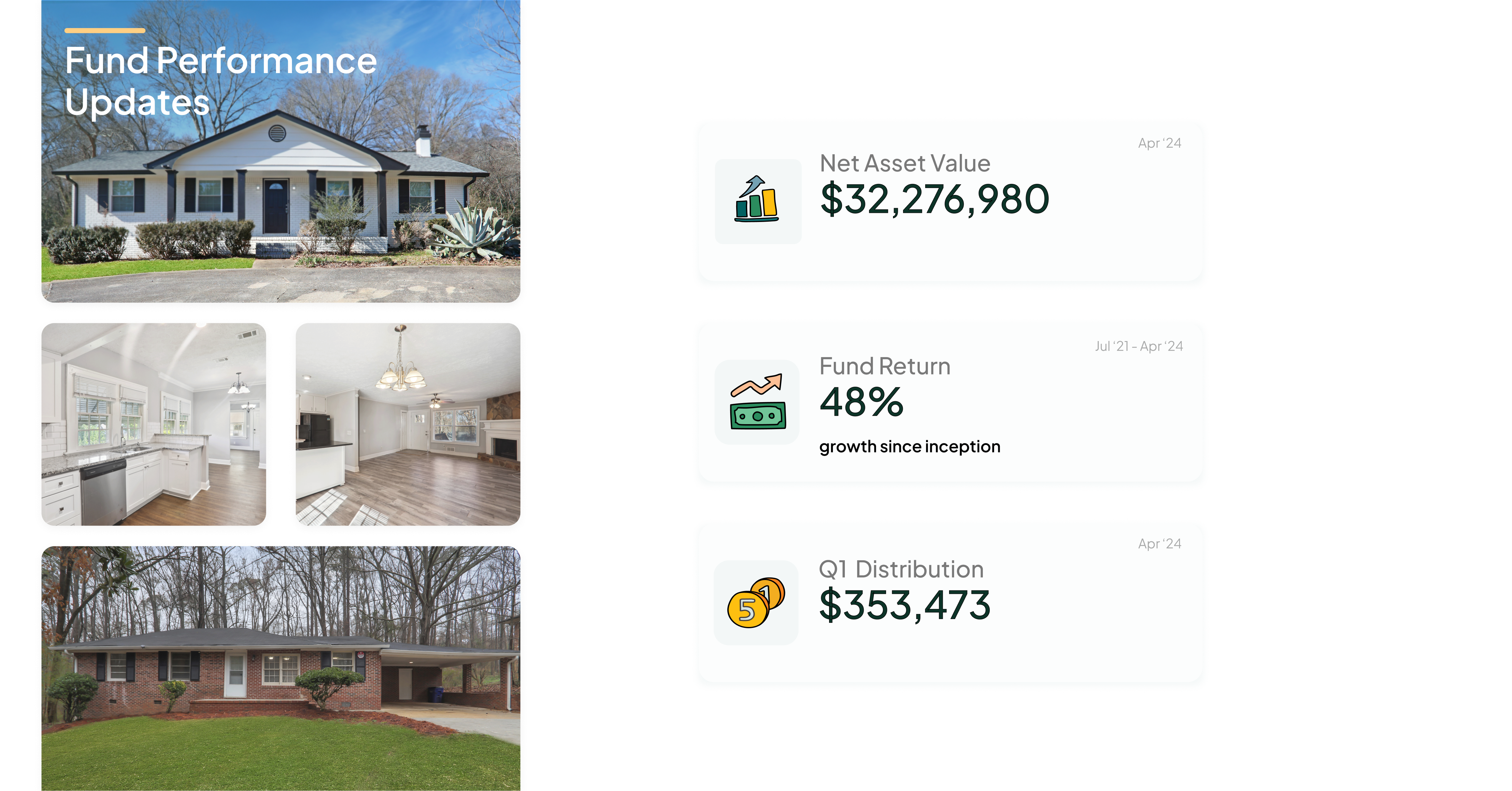

Roots, through its REIT (real estate investment trust), offers a portfolio of residential rental properties in the greater Atlanta area.

A REIT is a company that owns real estate properties across different kinds of real estate sectors and allows investors to acquire ownership in a diversified portfolio of real estate with the ease of investing in a stock. REITs are a total return investment, which means they share the money made by the properties with all the shareholders in the form of dividends, as the initial investment can continue to grow along with the value of the properties.

The Roots REIT has a unique model in which residents of Roots' properties get invested in the fund for being good renters. By simply paying rent on time, taking care of their property, and being a good neighbor, a Roots resident can gain tangible equity in real estate, something that's incredibly rare to find in a country where the average renter has less than $1,000 in savings.

This model has led to less vacancy, lower turnover costs, and higher returns for its investors, all while giving people from all walks of life the opportunity to own while renting.

Roots distributes profits quarterly and allows its investors to reinvest, cash out their distributions, or liquidate their holdings, making a great way to save and grow your money, with the ability to liquidate if something comes up.

Minimum Investment

Roots allows you to invest with a minimum of $100.

Fees

Roots has a low fee structure, with only a $5 transaction fee for your first investment and a $3 transaction fee on any subsequent investment, which is a much lower and simpler fee structure than most private real estate investment opportunities. If you liquidate before one year with the fund, there is a 6% fee, but after the one-year mark, there is no liquidation fee.

Investor type

Roots is open to both accredited and non accredited investors.

Advantages

Roots has returned 14.58% from April 1, 2023 - April 1, 2024, and 48% from July 1, 2021-April1, 2024 making it the best returner of capital on this list. Investors have earned over $1.4M in distributions since the fund launched in July of 2021.

Roots is in a great spot because its portfolio consists of properties in the fourth-hottest real estate market in the country, but the element most Roots investors and residents love the most isn't the high regular dividends or great returns; it's the fund's social impact. Roots is on a mission to increase homeownership through a plan to reward tenants with an equity stake so they can start building wealth while you build generational wealth.

Disadvantages

Roots is only in the residential real estate asset class.

Overview

Betterment is a reliable robo-advisor choice for those who want to get serious about investing for something big, like a home down payment, college fund, or their own retirement.

Betterment's algorithms match their user's risk tolerance and specific goals to a variety of diversified portfolios consisting of low-cost ETFs. Robo-advisors do all the heavy lifting behind the scenes, managing all necessary data analysis and adapting investment expertise to fit each customer's circumstances.

Betterment's perks don't end with their robo-advisor program (whose core fund has returned 7.7% annually since Betterment started). The most impressive aspect to Betterment? It's savings account APY (annual percentage yield), which comes in at 4.75%, vanquishing every other APY on this list. While Betterment's savings account doesn't come with all of the bonuses from some of the other companies on this list, a 4.75% APY with no minimum balance is hard to beat.

Minimum Investment

A modest $10 minimum deposit is needed to start investing with Betterment, but for users employing their premium version, a $100,000 minimum account balance is required.

Fees

Unlike some other robo-investment platforms, Betterment charges a $4 monthly (or 0.25% annually) fee for investing. These fees average $4.73 per use. For those who choose to invest in cryptocurrency with Betterment, there is a 1% annual fee and subsequent trading fees.

Investor Type

The barrier to entry for a standard Betterment account is pretty low, but there are more fitting options if you want better access to financial advisors on a budget.

Advantages

Betterment's APY is fantastic and its returns are dependable. Betterment's robo-investing philosophy is sound, and the investing process is relatively easy.

Disadvantages

Betterment has been criticized for its customer service, with many users saying that it took weeks to get help from Betterment's support staff and others mentioning that they were surprised by long withdrawal timelines.

Overview:

While some people may only know SoFi as the eponym of the Los Angeles Rams' stadium, the bank provides a lot of great financial services for its customers. These offerings include online bank accounts with generous APYs, robo-investing products, lending products, financial planning services, a credit card with 2% cash back rewards on all purchases, and much more.

While Chime's 2% APY (annual percentage yield) offer on its savings accounts is impressive, SoFi blows them out of the water. SoFi's checking accounts offer a 0.50% APY without account fees or balance minimums. SoFi offers customers an APY of up to 4.60% for their savings accounts, one of the highest of its kind for a national bank. SoFI maintains many of the same perks that Chime does (no minimum balance to open, no overdraft fees, no account maintenance fees, early direct deposits, ect.); it also has a substantially better reputation.

SoFi also offers a robo-investing option to generate further gains. SoFI aims to understand its client's investment goals, using an algorithm to carefully craft a series of low-risk ETFs that align with those goals.

SoFi also offers complimentary access to human financial advisors. When the markets fluctuate and change, SoFi rebalances its portfolios to align with its customers' investment goals.

Minimum Investment

SoFi has no minimum requirement to start banking with them. Prospective users can start with as little as $0. For robo-investing, you can get started with as little as $5.

Fees

Like Chime, SoFi's only fee comes from customers using out-of-network ATM locations. Considering SoFi also has over 55,000 fee-free ATM locations, fees aren't usually a concern for customers.

Investor Type

Anyone can bank or invest with SoFi.

Advantages

SoFi's APY is hard to beat for a bank, and unlike Chime, it appears to be very secure based on customer reviews. Since SoFi offers so many financial services, it's seen as a one-stop-shop for all things finance, but with limited fees (something that can't be said for many other companies on this list).

Disadvantages

While SoFI's APY is incredibly high for a bank, and they offer a smart robo-investing option…. you'd probably be surprised to learn that other financial services on this list have historically offered even better returns.

Overview

Like many of the companies on this list, Stash Financial offers a platform for users to bank and invest. Stash is excellent for people learning to invest, as it provides a wide variety of financial education resources and, like Acorns and Chime, has its own special round-up program.

With Stash's round-up program, users purchase goods with their Stash Stock-Back Card, and Stash automatically rounds the total up to the nearest dollar and invests the spare change into a matching stock or a stock of their choice.

Stash prioritizes custodial accounts so parents can build out portfolios for their children before they're of a fiscally responsible age to invest in their futures. To complement its investment services, Stash provides a respectable online banking account. There are no monthly or overdraft fees. Users get a debit card, mobile payments, and free access to over 55,000 ATMs.

Minimum Investment

Stash aims to make investing approachable for beginners. The service has a $0 account minimum (though managed Smart Portfolios require $5 to get started).

Fees

Compared to many of the other platforms on this list, Stash's fees are steep. The standard Stash account costs $3 per month, while their premium service, Stash+, costs $9 per month.

Investor Type:

Anyone can invest with Stash.

Advantages

Like Acorns, Stash makes investing approachable to even the most novice investor. For parents looking to teach their children the power of investing, Stash's Stock-Back Card, educational resources, and custodial accounts program provide services children can easily grasp. Stash also allows users to buy fractional shares of stocks, a privilege not always available in the financial services industry.

Disadvantages

Stash appeals to the do-it-yourself type of investor who wants to learn about finance, but any other of these financial platforms are much more passive, and many have significantly lower fees. For what Stash provides novice users, it lacks many of the bonuses other platforms offer bank users and investors.

Overview

Acorns is an easy platform for anyone beginning their investment journey, as it offers users a way to invest passively without headaches. It acts as a robo-advisor that invests your spare change — and any other contributions you make — into a selection of about 25 low-cost, diversified ETFs (Exchange Traded Funds).

An ETF is an investment fund and exchange-traded product that combines features of mutual funds and individual stocks. ETFs are designed to track the performance of a specific index, commodity, bond, or basket of assets (like Blackrock's iShares Core S&P 500 ETF, which aims to replicate the performance of the S&P 500 index).

With a debit or credit card linked to an Acorn account, investors can "Round-Up" their purchases to the nearest dollar and watch their money go safely into an accretive ETF or fund their accounts through recurring or on-demand deposits. This way, yesterday's grocery store change is tomorrow's retirement plan.

Minimum Investment

To invest with Acorns, you will need a minimum of $5 to start.

Fees

Acorns invests your savings into ETFs selected based on your financial goals and risk-comfortability, and they allow users to contribute as little as $5 to their account with monthly flat fee rates between $3, $5, and $9, depending on their tier selection.

Investor Type

Anyone can start investing with Acorns.

Advantages

Acorns is relatively inexpensive (compared to traditional banks) and very approachable. Round-Ups make it easy to put investing on autopilot. Because your contributions can be so small with this tool, it makes investing accessible for almost anyone- Acorns seems to be the perfect way for a college student to put money away towards their student loans or the downpayment on their first house without even thinking about it.

Disadvantages

Acorns fees favor investors with larger balances, and are significantly higher than other robo-investing platforms. Even with the lowest tier (Acorns Personal), the $12 in annual management fees translates to 1.2% of a $1,000 balance; other top robo-advisors with percentage-based fees charge only one-tenth of that.

Ready To Get Started? Invest With Roots

Start InvestingImagine owning real estate where your renters wanted it to succeed as much as you do.

Start investing with as little as $100, and own a piece of the only REIT that creates wealth for both its investors and its residents. It took us years to build Roots, but you can invest in as little as 5 minutes.

Sources